Revealed on February twenty fifth, 2025 by Bob Ciura

Excessive dividend shares means extra earnings for each greenback invested. All different issues equal, the upper the dividend yield, the higher.

On this analysis report, we analyze 10 dividend dynamos providing excessive dividend yields of 5.0% and better.

The free excessive dividend shares checklist spreadsheet beneath has our full checklist of particular person securities (shares, REITs, MLPs, and many others.) with with 5%+ dividend yields.

You possibly can obtain a free copy by clicking on the hyperlink beneath:

Not solely do the shares on this article have excessive yields above 5%, they’re additionally producing robust development.

The mixture of a excessive beginning yield, plus long-term development, may produce robust whole returns within the years forward.

To qualify for this checklist, we screened out any high-yield shares with our lowest Dividend Danger Rating of ‘F’, to attempt to filter out shares in peril of reducing their dividends.

The ten shares are sorted by five-year anticipated underlying enterprise development, from lowest to highest.

Desk of Contents

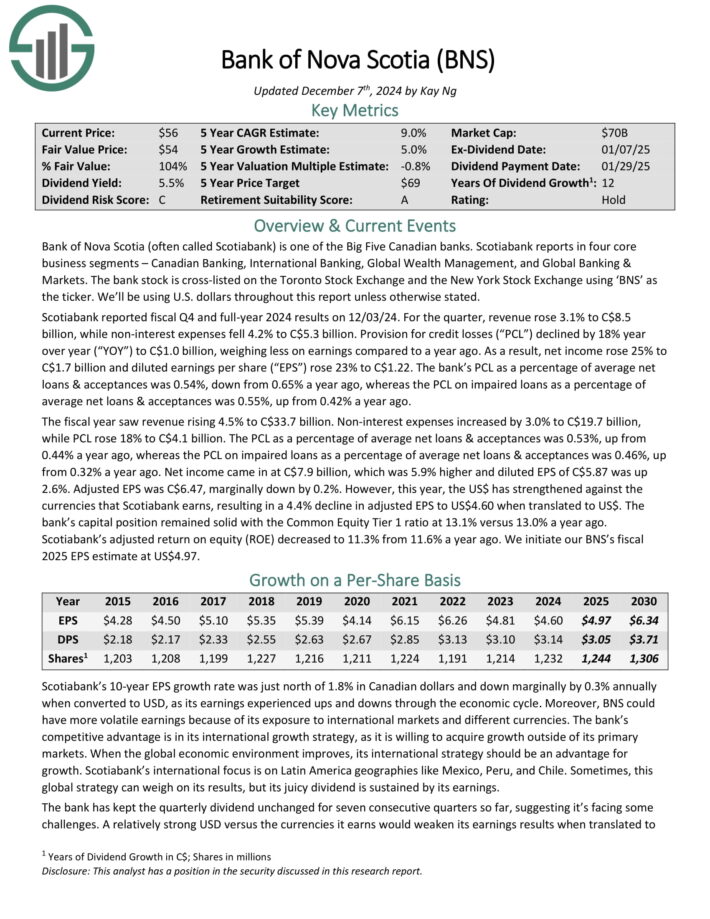

Dividend Dynamo #10: Financial institution of Nova Scotia (BNS)

5-year annual anticipated enterprise development: 5.0%

Financial institution of Nova Scotia (typically known as Scotiabank) is the fourth-largest monetary establishment in Canada behind the Royal Financial institution of Canada, the Toronto-Dominion Financial institution and Financial institution of Montreal.

Scotiabank reviews in 4 core enterprise segments – Canadian Banking, Worldwide Banking, World Wealth Administration, and World Banking & Markets.

Scotiabank reported fiscal This autumn and full-year 2024 outcomes on 12/03/24. For the quarter, income rose 3.1% to C$8.5 billion, whereas non-interest bills fell 4.2% to C$5.3 billion. Provision for credit score losses (“PCL”) declined by 18% 12 months over 12 months (“YOY”) to C$1.0 billion, weighing much less on earnings in comparison with a 12 months in the past.

In consequence, web earnings rose 25% to C$1.7 billion and diluted earnings per share (“EPS”) rose 23% to C$1.22. The financial institution’s PCL as a share of common web loans & acceptances was 0.54%, down from 0.65% a 12 months in the past, whereas the PCL on impaired loans as a share of common web loans & acceptances was 0.55%, up from 0.42% a 12 months in the past.

The fiscal 12 months noticed income rising 4.5% to C$33.7 billion. Non-interest bills elevated by 3.0% to C$19.7 billion, whereas PCL rose 18% to C$4.1 billion.

The PCL as a share of common web loans & acceptances was 0.53%, up from 0.44% a 12 months in the past, whereas the PCL on impaired loans as a share of common web loans & acceptances was 0.46%, up from 0.32% a 12 months in the past.

Click on right here to obtain our most up-to-date Certain Evaluation report on BNS (preview of web page 1 of three proven beneath):

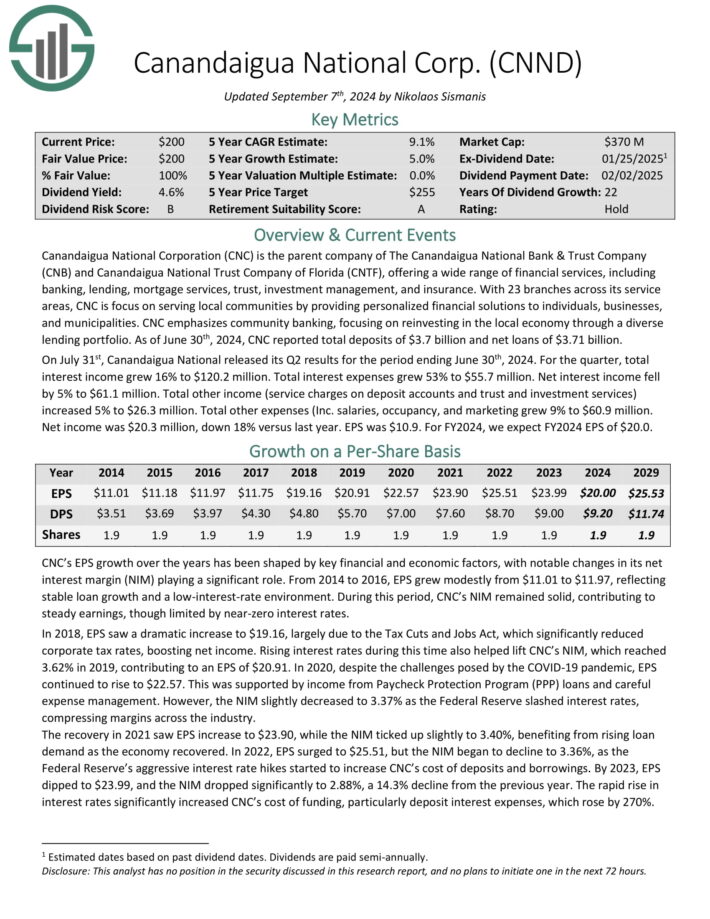

Dividend Dynamo #9: Canandaigua Nationwide Company (CNND)

5-year annual anticipated enterprise development: 5.0%

Canandaigua Nationwide Company (CNC) is the mum or dad firm of The Canandaigua Nationwide Financial institution & Belief Firm (CNB) and Canandaigua Nationwide Belief Firm of Florida (CNTF), providing a variety of monetary providers, together with banking, lending, mortgage providers, belief, funding administration, and insurance coverage.

With 23 branches throughout its service areas, CNC is concentrate on serving native communities by offering personalised monetary options to people, companies, and municipalities. CNC emphasizes group banking, specializing in reinvesting within the native financial system by way of a various lending portfolio.

Transferring ahead, we count on CNC’s EPS to develop at a CAGR of 5%. Notice that the corporate has elevated its dividend yearly since 2002, marking 22 years of consecutive annual dividend will increase.

Click on right here to obtain our most up-to-date Certain Evaluation report on CNND (preview of web page 1 of three proven beneath):

Dividend Dynamo #8: United Bancorp, Inc. (UBCP)

5-year annual anticipated enterprise development: 6.0%

United Bancorp a monetary holding firm primarily based in the USA, working primarily by way of its wholly-owned subsidiary, United Financial institution.

The corporate affords a variety of banking providers together with retail and industrial banking, mortgage lending, and funding providers.

A few of its different options embrace checking and financial savings accounts, private and enterprise loans, in addition to wealth administration.

On August twenty second, 2024, United Bancorp raised its dividend by 1.4% to a quarterly fee of $0.1775. On a year-over-year foundation, this was a 4.4% enhance.

On November sixth, 2024, United Bancorp posted its Q3 outcomes for the interval ending September thirtieth, 2024. The corporate reported whole curiosity earnings of $9.94 million, which was up 3.0% year-over-year.

This development was primarily pushed by a 13.9% rise in curiosity earnings on loans, regardless of a 32.9% decline in mortgage price earnings and a 15.2% lower in curiosity earnings from securities.

Nonetheless, whole curiosity bills elevated by about 23.4%, resulting in a 6.5% decline in web curiosity earnings, which fell to $6.1 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on UBCP (preview of web page 1 of three proven beneath):

Dividend Dynamo #7: Edison Worldwide (EIX)

5-year annual anticipated enterprise development: 6.7%

Edison Worldwide is a renewable vitality firm that’s energetic in vitality era and distribution. It additionally operates an vitality providers and a applied sciences enterprise. The corporate was based in 1987 and is headquartered in Rosemead, CA.

On October 29, 2024, Edison Worldwide reported its monetary outcomes for the third quarter ended September 30, 2024.

The corporate delivered a GAAP web earnings of $516 million, or $1.33 per diluted share, marking a considerable enhance from $155 million, or $0.40 per diluted share, in the identical quarter final 12 months.

On an adjusted foundation, Edison achieved core earnings of $582 million, or $1.51 per diluted share, up from $531 million, or $1.38 per diluted share, in Q3 2023.

Income for the quarter was $5.20 billion, reflecting a ten.61% year-over-year development and surpassing expectations by $192.39 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on Edison Worldwide (EIX) (preview of web page 1 of three proven beneath):

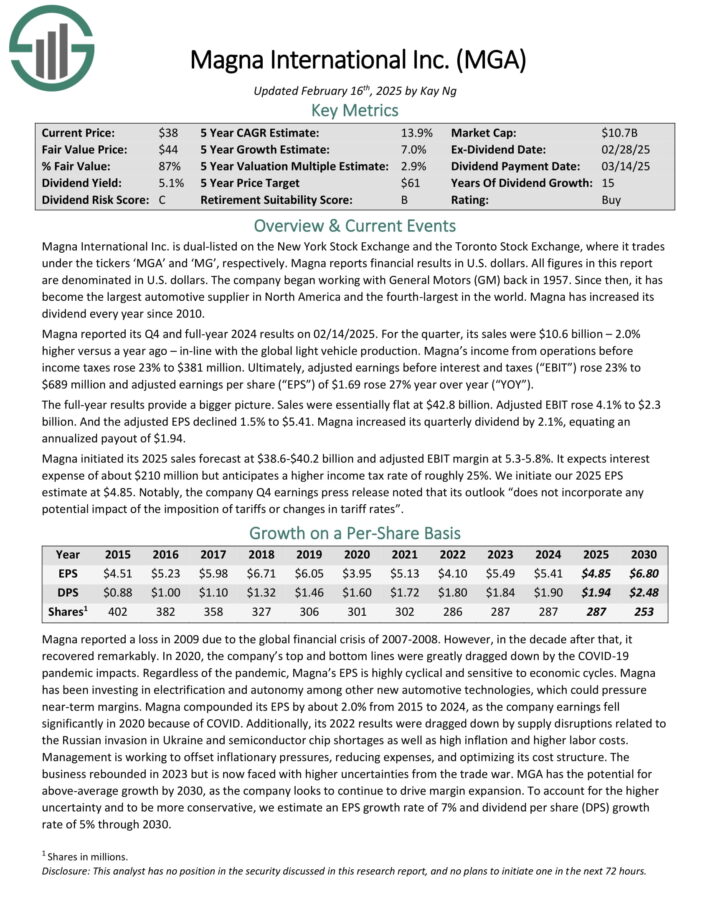

Dividend Dynamo #6: Magna Worldwide Inc. (MGA)

5-year annual anticipated enterprise development: 7.0%

Magna Worldwide Inc. is dual-listed on the New York Inventory Alternate and the Toronto Inventory Alternate. The corporate started working with Normal Motors (GM) again in 1957.

Since then, it has turn out to be the most important automotive provider in North America and the fourth-largest on the planet. Magna has elevated its dividend yearly since 2010.

Magna reported its This autumn and full-year 2024 outcomes on 02/14/2025. For the quarter, its gross sales had been $10.6 billion – 2.0% larger versus a 12 months in the past – in-line with the worldwide mild car manufacturing. Magna’s earnings from operations earlier than earnings taxes rose 23% to $381 million.

Adjusted earnings earlier than curiosity and taxes (“EBIT”) rose 23% to $689 million and adjusted earnings per share (“EPS”) of $1.69 rose 27% 12 months over 12 months (“YOY”).

The complete-year outcomes present an even bigger image. Gross sales had been primarily flat at $42.8 billion. Adjusted EBIT rose 4.1% to $2.3 billion. And the adjusted EPS declined 1.5% to $5.41. Magna elevated its quarterly dividend by 2.1%, equating an annualized payout of $1.94.

Magna initiated its 2025 gross sales forecast at $38.6-$40.2 billion and adjusted EBIT margin at 5.3-5.8%.

Click on right here to obtain our most up-to-date Certain Evaluation report on MGA (preview of web page 1 of three proven beneath):

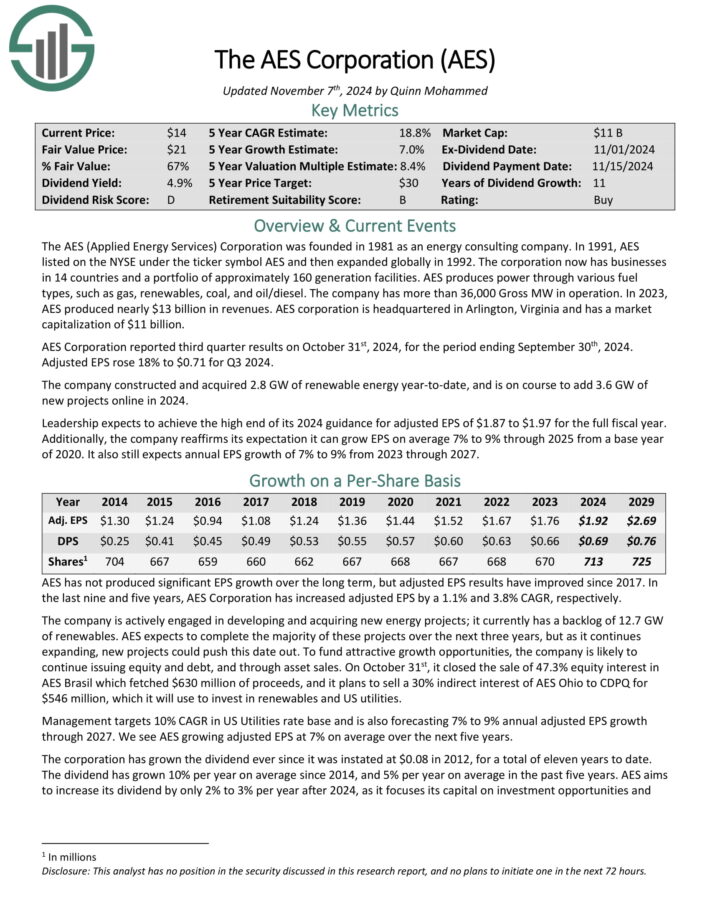

Dividend Dynamo #5: AES Corp. (AES)

5-year annual anticipated enterprise development: 7.0%

The AES (Utilized Vitality Providers) Company was based in 1981 as an vitality consulting firm. It now has companies in 14 nations and a portfolio of roughly 160 era amenities.

AES produces energy by way of numerous gasoline varieties, similar to gasoline, renewables, coal, and oil/diesel. The corporate has greater than 36,000 Gross MW in operation.

AES Company reported third quarter outcomes on October thirty first, 2024, for the interval ending September thirtieth, 2024. Adjusted EPS rose 18% to $0.71 for Q3 2024.

The corporate constructed and bought 2.8 GW of renewable vitality year-to-date, and is heading in the right direction so as to add 3.6 GW of recent tasks on-line in 2024.

Supply: Investor Presentation

Management expects to realize the excessive finish of its 2024 steering for adjusted EPS of $1.87 to $1.97 for the complete fiscal 12 months. Moreover, the corporate reaffirms it additionally nonetheless expects annual EPS development of seven% to 9% from 2023 by way of 2027.

The corporate is actively engaged in growing and buying new vitality tasks.

It at the moment has a backlog of 12.7 GW of renewables. AES expects to finish nearly all of these tasks by way of 2027.

Click on right here to obtain our most up-to-date Certain Evaluation report on AES (preview of web page 1 of three proven beneath):

Dividend Dynamo #4: Brookfield Infrastructure Companions LP (BIP)

5-year annual anticipated enterprise development: 7.0%

Brookfield Infrastructure Companions L.P. is among the largest international house owners and operators of infrastructure networks, which incorporates operations in sectors similar to vitality, water, freight, passengers, and knowledge.

Brookfield Infrastructure Companions is one in every of 4 publicly-traded listed partnerships that’s operated by Brookfield Asset Administration (BAM).

BIP has delivered 8% compound annual distribution development over the previous 10 years.

Supply: Investor Presentation

BIP reported resilient outcomes for This autumn 2024 on 01/30/25. The diversified utility reported funds from operations of $646 million, up 3.9% 12 months over 12 months. FFO per unit was $0.82, up 3.8%.

For the complete 12 months, FFO per unit was $3.12, up 5.8% from the earlier 12 months. Normalized for the influence of overseas alternate, the FFOPU development would have been 10%, which higher displays the enterprise’s operational power.

For the 12 months, it achieved its goal of $2 billion capital recycling proceeds. It additionally deployed +$1.1 billion throughout its backlog of natural development tasks and three tuck-in acquisitions, which ought to assist contribute to development. It additionally added ~$1.8 billion of recent tasks to its capital backlog.

Click on right here to obtain our most up-to-date Certain Evaluation report on Brookfield Infrastructure Companions (preview of web page 1 of three proven beneath):

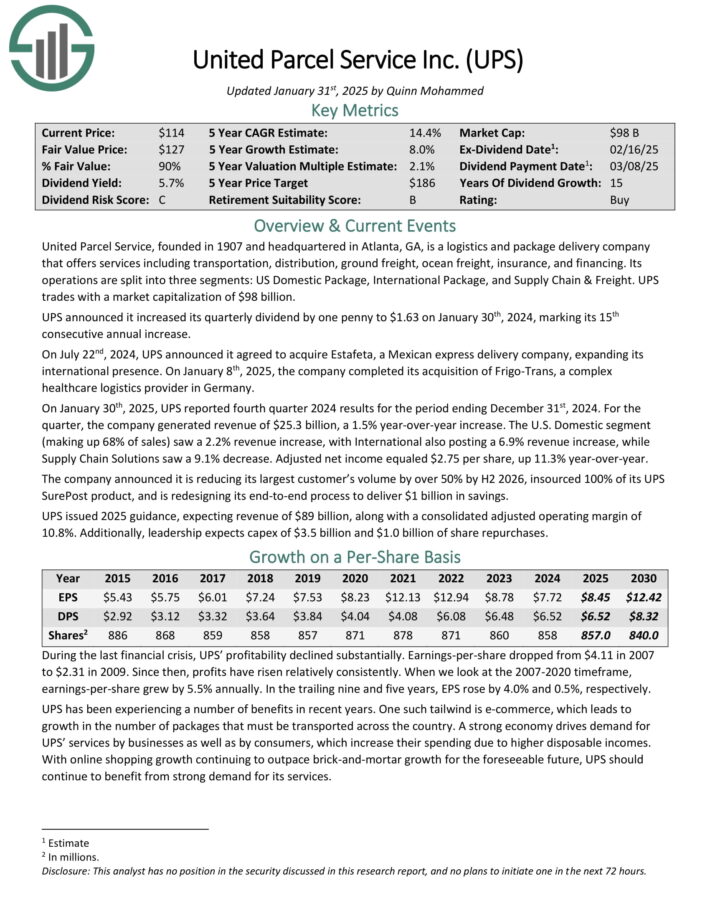

Dividend Dynamo #3: United Parcel Service (UPS)

5-year annual anticipated enterprise development: 8.0%

United Parcel Service is a logistics and bundle supply firm that provides providers together with transportation, distribution, floor freight, ocean freight, insurance coverage, and financing.

Its operations are break up into three segments: US Home Package deal, Worldwide Package deal, and Provide Chain & Freight.

On January thirtieth, 2025, UPS reported fourth quarter 2024 outcomes for the interval ending December thirty first, 2024. For the quarter, the corporate generated income of $25.3 billion, a 1.5% year-over-year enhance.

Supply: Investor Presentation

The U.S. Home section (making up 68% of gross sales) noticed a 2.2% income enhance, with Worldwide additionally posting a 6.9% income enhance, whereas Provide Chain Options noticed a 9.1% lower. Adjusted web earnings equaled $2.75 per share, up 11.3% year-over-year.

The corporate introduced it’s decreasing its largest buyer’s quantity by over 50% by H2 2026, insourced 100% of its UPS SurePost product, and is redesigning its end-to-end course of to ship $1 billion in financial savings.

Click on right here to obtain our most up-to-date Certain Evaluation report on UPS (preview of web page 1 of three proven beneath):

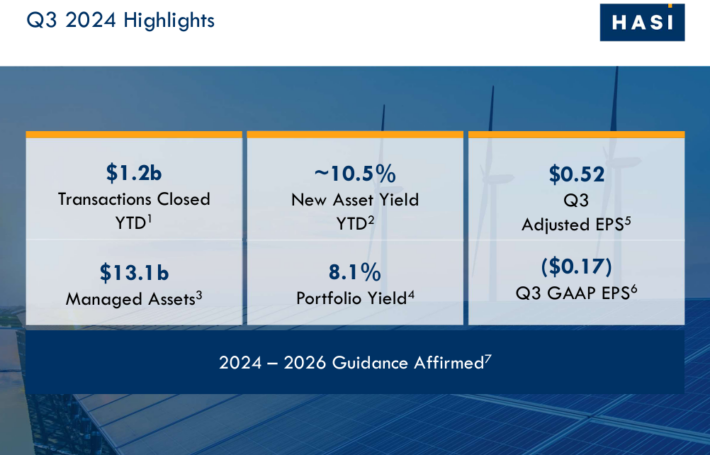

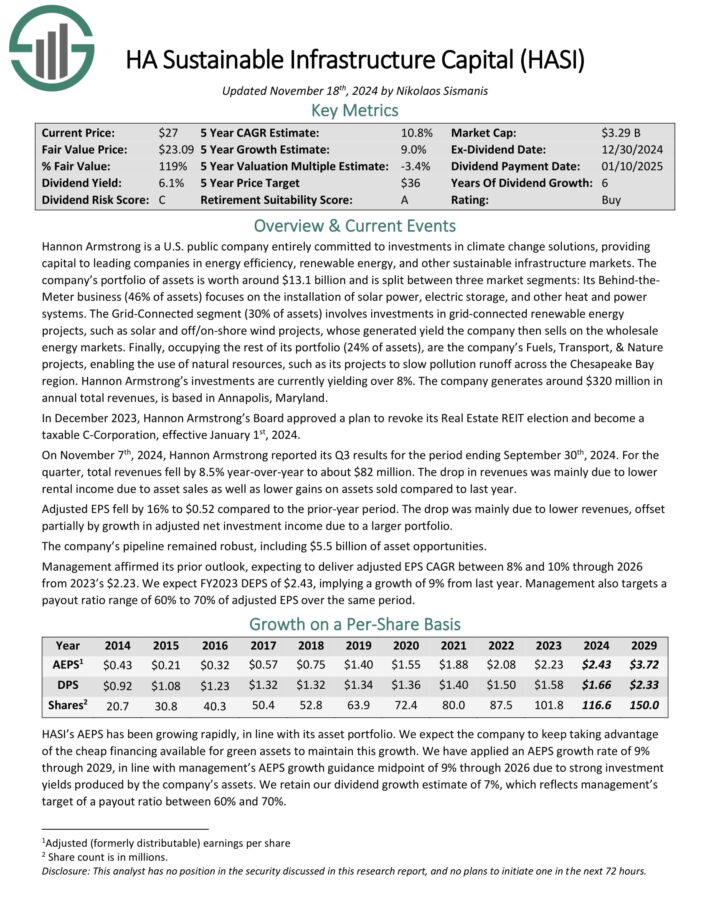

Dividend Dynamo #2: HA Sustainable Infrastructure Capital (HASI)

5-year annual anticipated enterprise development: 9.0%

Hannon Armstrong is a U.S. public firm that invests in local weather change options, offering capital to main firms in vitality effectivity, renewable vitality, and different sustainable infrastructure markets.

The corporate’s portfolio of property is price round $13.1 billion and is break up between three market segments: Its Behind the Meter enterprise (46% of property) focuses on the set up of solar energy, electrical storage, and different warmth and energy techniques.

The Grid-Linked section (30% of property) entails investments in grid-connected renewable vitality tasks, similar to photo voltaic and off/on-shore wind tasks, whose generated yield the corporate then sells on the wholesale vitality markets.

Lastly, occupying the remainder of its portfolio (24% of property), are the corporate’s Fuels, Transport, & Nature tasks, enabling the usage of pure assets, similar to its tasks to gradual air pollution runoff throughout the Chesapeake Bay area.

Supply: Investor Presentation

On November seventh, 2024, Hannon Armstrong reported its Q3 outcomes for the interval ending September thirtieth, 2024. For the quarter, whole revenues fell by 8.5% year-over-year to about $82 million.

The drop in revenues was primarily on account of decrease rental earnings on account of asset gross sales in addition to decrease good points on property offered in comparison with final 12 months.

Adjusted EPS fell by 16% to $0.52 in comparison with the prior-year interval. The drop was primarily on account of decrease revenues, offset partially by development in adjusted web funding earnings on account of a bigger portfolio.

The corporate’s pipeline remained sturdy, together with $5.5 billion of asset alternatives. Administration affirmed its prior outlook, anticipating to ship adjusted EPS CAGR between 8% and 10% by way of 2026.

Click on right here to obtain our most up-to-date Certain Evaluation report on HASI (preview of web page 1 of three proven beneath):

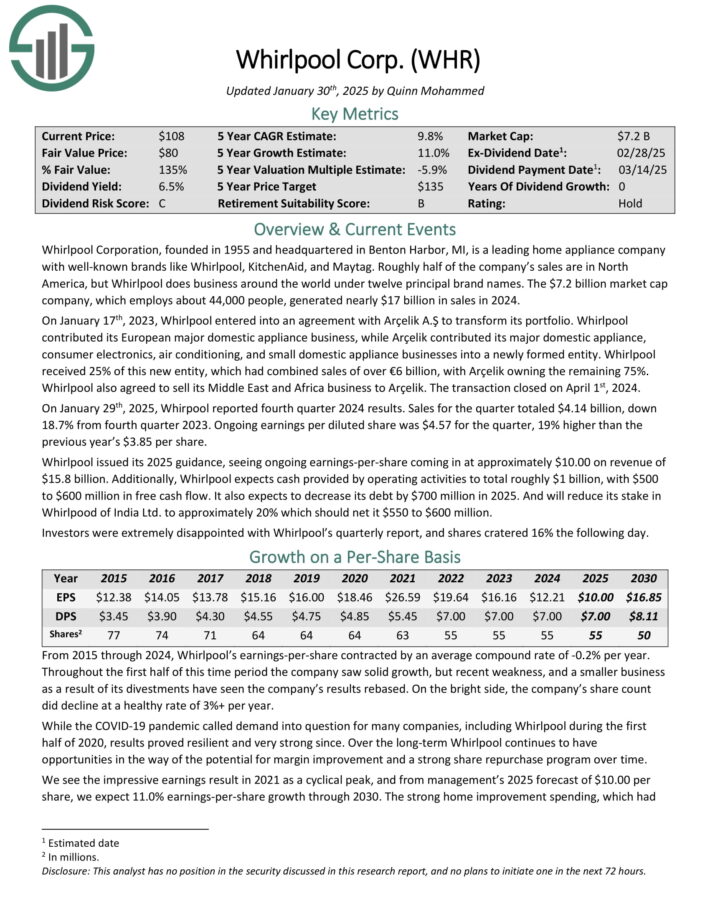

Dividend Dynamo #1: Whirlpool Corp. (WHR)

5-year annual anticipated enterprise development: 11.0%

Whirlpool Company, based in 1955 and headquartered in Benton Harbor, MI, is a number one dwelling equipment firm with high manufacturers Whirlpool, KitchenAid, and Maytag.

Roughly half of the corporate’s gross sales are in North America, however Whirlpool does enterprise all over the world underneath twelve principal model names. The corporate, which employs about 44,000 folks, generated practically $17 billion in gross sales in 2024.

Supply: Investor Presentation

On January twenty ninth, 2025, Whirpool reported fourth quarter 2024 outcomes. Gross sales for the quarter totaled $4.14 billion, down 18.7% from fourth quarter 2023. Ongoing earnings per diluted share was $4.57 for the quarter, 19% larger than the earlier 12 months’s $3.85 per share.

Whirlpool issued its 2025 steering, seeing ongoing earnings-per-share coming in at roughly $10.00 on income of $15.8 billion. Moreover, Whirlpool expects money supplied by working actions to whole roughly $1 billion, with $500 to $600 million in free money circulate.

Click on right here to obtain our most up-to-date Certain Evaluation report on WHR (preview of web page 1 of three proven beneath):

Remaining Ideas

Excessive dividend shares are naturally interesting to earnings traders, particularly when the S&P 500 Index is barely yielding roughly 1.3% on common.

Even higher, these 10 dividend dynamos mix a excessive present yield, with the potential for long-term enterprise development. On this manner, they may present robust whole returns by way of the mix of development and yield.

Buyers ought to proceed to watch every inventory to ensure their fundamentals and development stay on observe, significantly amongst shares with extraordinarily excessive dividend yields.

Extra Studying

In case you are taken with discovering different high-yield securities, the next Certain Dividend assets could also be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.