Up to date on March 14th, 2025 by Bob Ciura

Enterprise Growth Corporations, in any other case generally known as BDCs, are extremely widespread amongst revenue buyers. BDCs broadly have excessive dividend yields of 5% or greater.

This makes BDCs very interesting for revenue buyers similar to retirees. With this in thoughts, we’ve created a listing of BDCs.

You may obtain your free copy of our BDC listing, together with related monetary metrics similar to P/E ratios and dividend payout ratios, by clicking on the hyperlink beneath:

After all, earlier than investing in BDCs, buyers ought to perceive the distinctive traits of the sector.

This text will present an outline of BDCs. It’ll additionally listing our high 5 BDCs proper now as ranked by anticipated whole returns within the Certain Evaluation Analysis Database.

Desk Of Contents

The desk of contents beneath offers for straightforward navigation of the article:

Overview of BDCs

Enterprise Growth Corporations are closed-end funding companies. Their enterprise mannequin includes making debt and/or fairness investments in different firms, sometimes small or mid-size companies.

These goal firms might not have entry to conventional technique of elevating capital, which makes them appropriate companions for a BDC. BDCs put money into a wide range of firms, together with turnarounds, creating, or distressed firms.

BDCs are registered below the Funding Firm Act of 1940. As they’re publicly-traded, BDCs should even be registered with the Securities and Alternate Fee.

To qualify as a BDC, the agency should make investments not less than 70% of its property in non-public or publicly-held firms with market capitalizations of $250 million or beneath.

BDCs earn cash by investing with the aim of producing revenue, in addition to capital positive aspects on their investments if and when they’re offered.

On this means, BDCs function comparable enterprise fashions as a non-public fairness agency or enterprise capital agency.

The foremost distinction is that non-public fairness and enterprise capital funding is often restricted to accredited buyers, whereas anybody can put money into publicly-traded BDCs.

Why Make investments In BDCs?

The plain attraction for BDCs is their excessive dividend yields. It isn’t unusual to seek out BDCs with dividend yields above 5%. In some circumstances, sure BDCs present 10%+ yields.

After all, buyers ought to conduct an intensive quantity of due diligence, to ensure the underlying fundamentals assist the dividend.

As at all times, buyers ought to keep away from dividend cuts each time doable. Any inventory that has an abnormally excessive yield is a possible hazard.

Certainly, there are a number of danger components that buyers ought to know earlier than they put money into BDCs. At the beginning, BDCs are sometimes closely indebted.

That is commonplace throughout BDCs, as their enterprise mannequin includes borrowing to make investments in different firms. The tip result’s that BDCs are sometimes considerably leveraged firms.

When the financial system is robust and markets are rising, leverage will help amplify constructive returns.

Nevertheless, the flip aspect is that leverage can speed up losses as effectively, which may occur in bear markets or recessions.

One other danger to pay attention to is rates of interest. For the reason that BDC enterprise mannequin closely makes use of debt, buyers ought to perceive the rate of interest atmosphere earlier than investing.

For instance, rising rates of interest can negatively have an effect on BDCs if it causes a spike in borrowing prices.

Lastly, credit score danger is an extra consideration for buyers. As beforehand talked about, BDCs make investments in small to mid-size companies.

Subsequently, the standard of the BDC’s portfolio should be assessed, to ensure the BDC won’t expertise a excessive degree of defaults inside its funding portfolio.

This might trigger hostile outcomes for the BDC itself, which might negatively affect its skill to take care of distributions to shareholders.

One other distinctive attribute of BDCs that buyers ought to know earlier than shopping for is taxation. BDC dividends are sometimes not “certified dividends” for tax functions, which is mostly a extra favorable tax fee.

As a substitute, BDC distributions are taxable on the investor’s extraordinary revenue charges, whereas the BDC’s capital positive aspects and certified dividend revenue is taxed at capital positive aspects charges.

After taking all of this into consideration, buyers may determine that BDCs are a great match for his or her portfolios. If that’s the case, revenue buyers may take into account one of many following BDCs.

Tax Concerns Of BDCs

As at all times, buyers ought to perceive the tax implications of varied securities earlier than buying. Enterprise Growth Corporations should pay out 90%+ of their revenue as distributions.

On this means, BDCs are similar to Actual Property Funding Trusts.

One other issue to remember is that roughly 70% to 80% of BDC dividend revenue is often derived from extraordinary revenue.

Because of this, BDCs are broadly thought-about to be good candidates for a tax-advantaged retirement account similar to an IRA or 401k.

BDCs pay their distributions as a mixture of extraordinary revenue and non-qualified dividends, certified dividends, return of capital, and capital positive aspects.

Returns of capital cut back your tax foundation. Certified dividends and long-term capital positive aspects are taxed at decrease charges, whereas extraordinary revenue and non-qualified dividends are taxed at your private revenue tax bracket fee.

The Prime 5 BDCs Immediately

With all this in thoughts, listed here are our high 5 BDCs at present, ranked in keeping with their anticipated annual returns over the following 5 years.

BDC #5: Barings BDC Inc. (BBDC)

5-year anticipated annual return: 10.1%

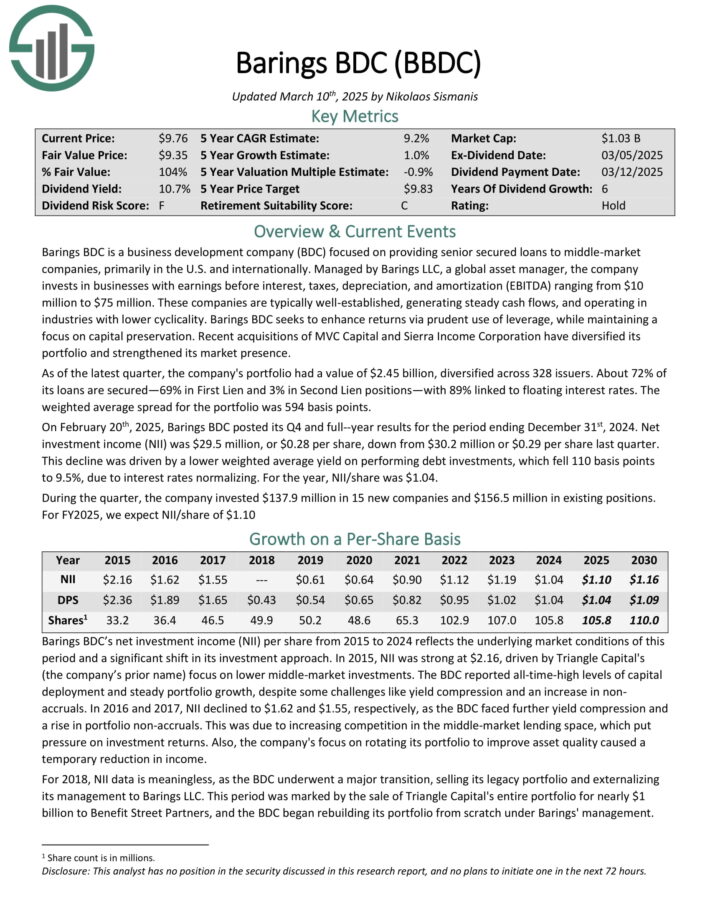

Barings BDC is a enterprise growth firm (BDC) centered on offering senior secured loans to middle-market firms, primarily within the U.S. and internationally.

Managed by Barings LLC, a world asset supervisor, the corporate invests in companies with earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) starting from $10 million to $75 million.

Supply: Investor Presentation

On February twentieth, 2025, Barings BDC posted its This fall and full–12 months outcomes for the interval ending December thirty first, 2024. Web funding revenue (NII) was $29.5 million, or $0.28 per share, down from $30.2 million or $0.29 per share final quarter.

This decline was pushed by a decrease weighted common yield on performing debt investments, which fell 110 foundation factors to 9.5%, attributable to rates of interest normalizing. For the 12 months, NII/share was $1.04.

Through the quarter, the corporate invested $137.9 million in 15 new firms and $156.5 million in present positions. For FY2025, we anticipate NII/share of $1.10.

Click on right here to obtain our most up-to-date Certain Evaluation report on BBDC (preview of web page 1 of three proven beneath):

BDC #4: Blue Owl Capital (OBDC)

5-year anticipated annual return: 10.3%

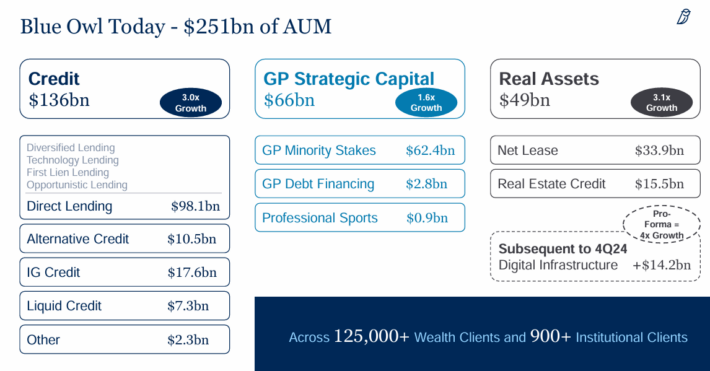

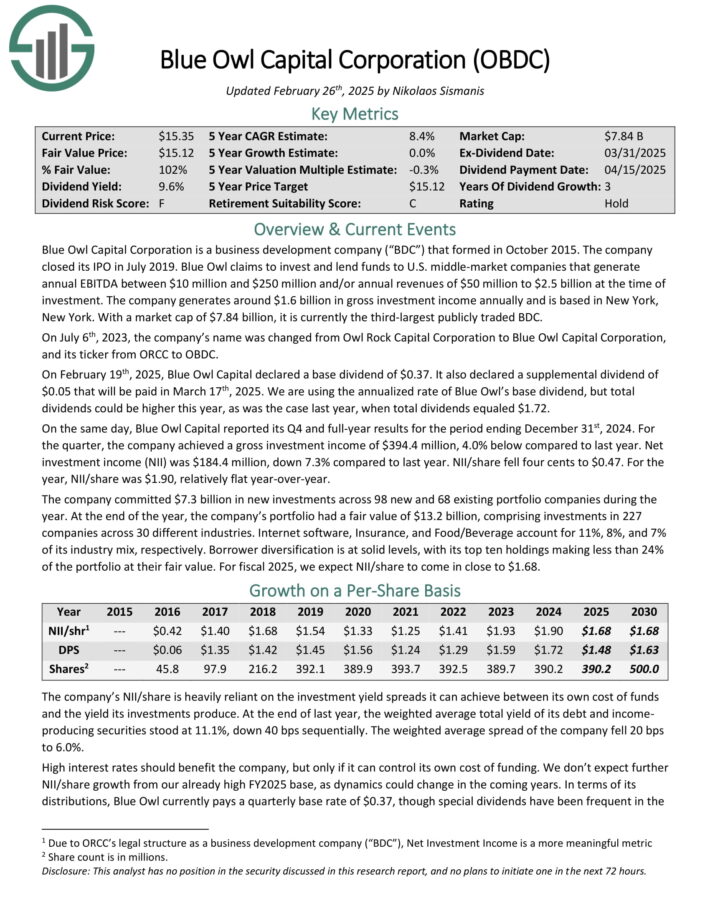

Blue Owl Capital Company is a enterprise growth firm (“BDC”) that fashioned in October 2015.

It invests and lends funds to U.S. middle-market firms that generate annual EBITDA between $10 million and $250 million and/or annual revenues of $50 million to $2.5 billion.

The corporate generates round $1.2 billion in gross funding revenue yearly and is predicated in New York, New York.

Supply: Investor Presentation

Blue Owl Capital reported its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, the corporate achieved a gross funding revenue of $394.4 million, 4.0% beneath in comparison with final 12 months.

Web funding revenue (NII) was $184.4 million, down 7.3% in comparison with final 12 months. NII/share fell 4 cents to $0.47.

For the 12 months, NII/share was $1.90, comparatively flat year-over-year.

The corporate dedicated $7.3 billion in new investments throughout 98 new and 68 present portfolio firms through the 12 months. On the finish of the 12 months, the corporate’s portfolio had a good worth of $13.2 billion, comprising investments in 227 firms throughout 30 totally different industries.

Click on right here to obtain our most up-to-date Certain Evaluation report on OBDC (preview of web page 1 of three proven beneath):

BDC #3: Capital Southwest Corp. (CSWC)

5-year anticipated annual return: 11.1%

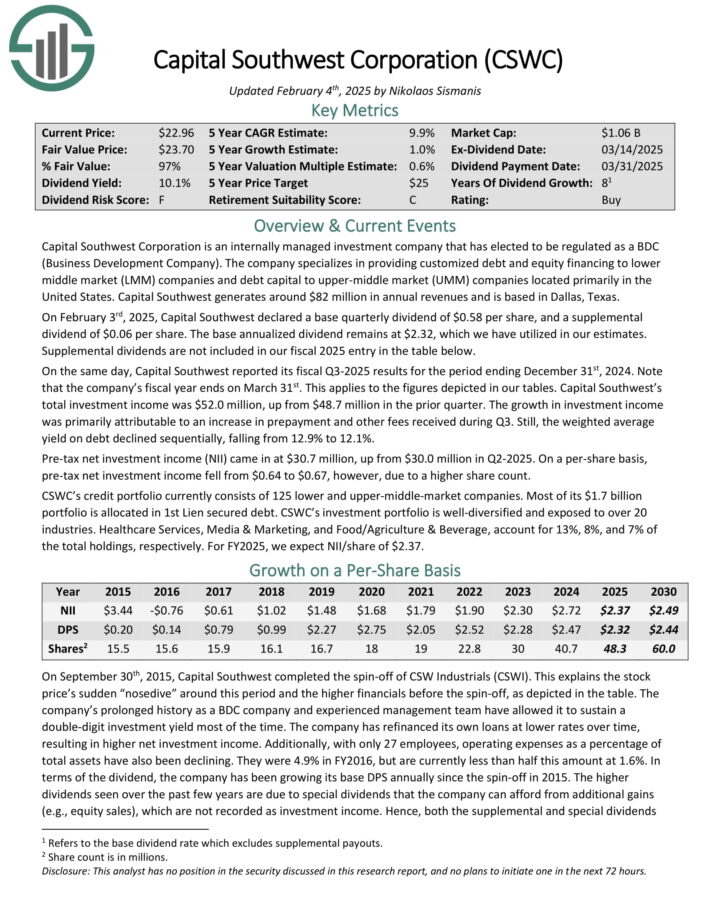

Capital Southwest Company is an internally-managed funding firm. The corporate focuses on offering personalized debt and fairness financing to decrease center market (LMM) firms and debt capital to upper-middle market (UMM) firms situated primarily in the US.

Capital Southwest generates round $82 million in annual revenues and is predicated in Dallas, Texas.

On February third, 2025, Capital Southwest declared a base quarterly dividend of $0.58 per share, and a supplemental dividend of $0.06 per share. The bottom annualized dividend stays at $2.32 per share.

Capital Southwest reported its fiscal Q3-2025 outcomes. Complete funding revenue was $52.0 million, up from $48.7 million within the prior quarter.

The expansion in funding revenue was primarily attributable to a rise in prepayment and different charges acquired throughout Q3.

Nonetheless, the weighted common yield on debt declined sequentially, falling from 12.9% to 12.1%.

Click on right here to obtain our most up-to-date Certain Evaluation report on CSWC (preview of web page 1 of three proven beneath):

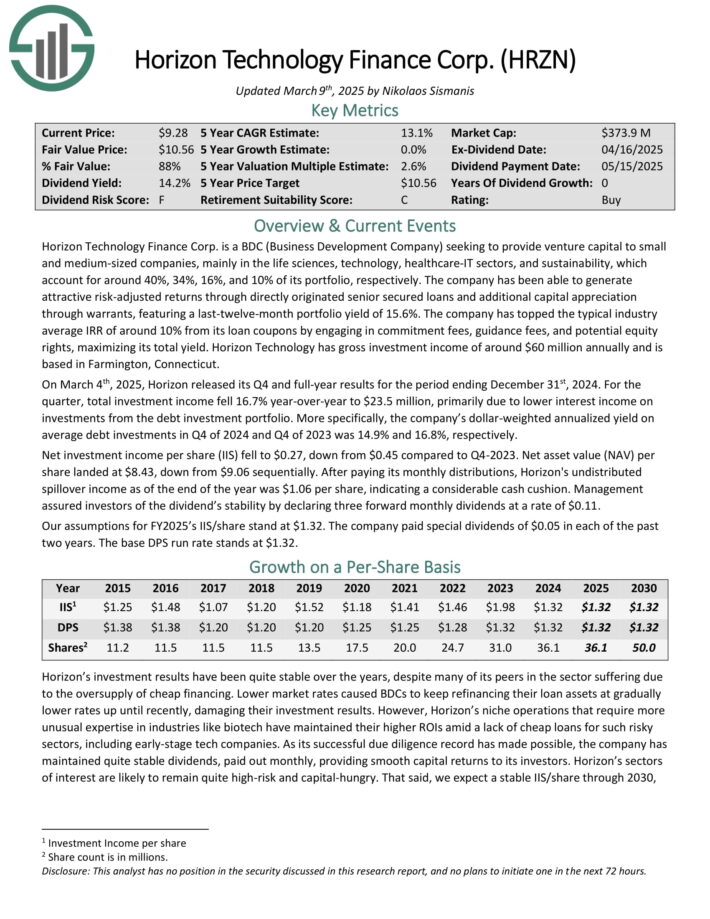

BDC #2: Horizon Know-how Finance (HRZN)

5-year anticipated annual return: 13.6%

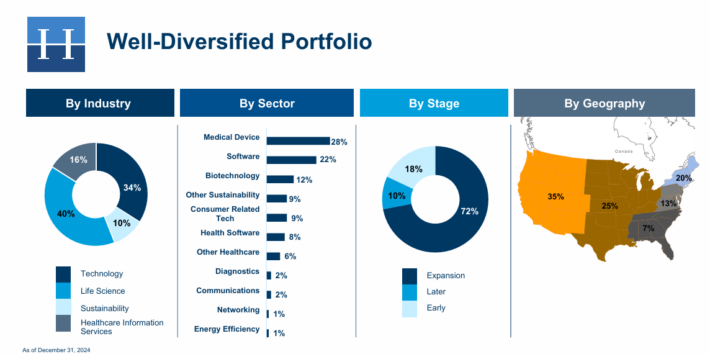

Horizon Know-how Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the expertise, life sciences, and healthcare–IT sectors.

The corporate has generated enticing danger–adjusted returns via straight originated senior secured loans and extra capital appreciation via warrants.

Supply: Investor Presentation

On March 4th, 2025, Horizon launched its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, whole funding revenue fell 16.7% year-over-year to $23.5 million, primarily attributable to decrease curiosity revenue on investments from the debt funding portfolio.

Extra particularly, the corporate’s dollar-weighted annualized yield on common debt investments in This fall of 2024 and This fall of 2023 was 14.9% and 16.8%, respectively.

Web funding revenue per share (IIS) fell to $0.27, down from $0.45 in comparison with This fall-2023. Web asset worth (NAV) per share landed at $8.43, down from $9.06 sequentially.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRZN (preview of web page 1 of three proven beneath):

BDC #1: NewtekOne Inc. (NEWT)

5-year anticipated annual return: 15.1%

Newtek One offers monetary and enterprise providers to the small- and medium-sized enterprise market in the US.

What makes NewTek a novel firm is {that a} good portion of its revenue is derived from subsidiaries that present a wide selection of enterprise providers to its giant shopper base.

The corporate additionally will get a major quantity of its revenue from being an issuer of SBA (Small Enterprise Administration loans), which solely only a few BDCs are licensed to do.

On February twenty sixth, 2025, Newtek launched its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, Newtek reported web revenue of $18.3 million, or diluted earnings per share (EPS) of $0.69, representing a 62.8% improve over the prior 12 months. Web curiosity revenue elevated to $11.3 million, up 36.1% from This fall 2023.

Its whole property reached $2.1 billion, marking a 50% rise year-over-year, with loans held for funding rising 23% to $991.4 million.

Newtek’s web curiosity margin was 2.80%, a slight improve from the prior 12 months.

Moreover, the corporate’s Various Mortgage Program mortgage closings skyrocketed by 199% to $91.4 million. Newtek additionally achieved vital enhancements in return on tangible widespread fairness (ROTCE) and return on common property (ROAA), reaching 31.8% and 4.1%.

Click on right here to obtain our most up-to-date Certain Evaluation report on NEWT (preview of web page 1 of three proven beneath):

Closing Ideas

Enterprise Growth Corporations give retail buyers the chance to speculate not directly in small and mid-size companies.

Beforehand, funding in early-stage or creating firms was restricted to accredited buyers, via enterprise capital.

And, BDCs have apparent attraction for revenue buyers. BDCs broadly have excessive dividend yields above 5%, and plenty of BDCs pay dividends each month as an alternative of the extra typical quarterly cost schedule.

After all, buyers ought to take into account all the distinctive traits, together with however not restricted to the tax implications of BDCs.

Buyers must also concentrate on the danger components related to investing in BDCs, similar to the usage of leverage, rate of interest danger, and default danger.

If buyers perceive the assorted implications and make the choice to put money into BDCs, the 5 particular person shares on this listing might present enticing whole returns and dividends over the following a number of years.

At Certain Dividend, we regularly advocate for investing in firms with a excessive likelihood of accelerating their dividends each 12 months.

If that technique appeals to you, it might be helpful to flick thru the next databases of dividend development shares:

The Dividend Aristocrats Record: S&P 500 shares with 25+ years of dividend will increase.

The Dividend Kings Record is much more unique than the Dividend Aristocrats. It’s comprised of 54 shares with 50+ years of consecutive dividend will increase.

The Excessive Dividend Shares Record: shares that attraction to buyers within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Record: shares that pay dividends each month, for 12 dividend funds per 12 months.

The Dividend Champions Record: shares which have elevated their dividends for 25+ consecutive years.Notice: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have extra necessities like being within the S&P 500.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.