What Can We Count on from Lengthy-Run Asset Returns?

What can we realistically count on from investing throughout completely different asset lessons over the long term? That’s the form of big-picture query the “Lengthy-Run Asset Returns“ paper tackles—providing a sweeping take a look at how shares, bonds, actual property, and commodities have carried out over the previous 200 years. The paper goes past simply itemizing historic returns—it explains how dependable (or not) these numbers are by digging into the quirks and points hidden in very previous knowledge. The authors take a look at what occurs to returns whenever you embrace international locations or time durations that often get not noted, and so they present that the previous isn’t all the time as rosy—or as repeatable—because it might sound when you solely take a look at current a long time.

For anybody experimenting with Quantpedia’s Black-Litterman mannequin (introduced a number of days in the past), this paper is a helpful anchor. It provides context for setting your baseline return assumptions and helps you construct extra considerate views. As an alternative of simply guessing or utilizing current efficiency, you’ll be able to lean on a a lot deeper historic perspective—seeing what returns seemed like in numerous eras, how uncommon the Twentieth century actually was, and why right this moment’s market surroundings would possibly name for extra cautious expectations.

What are the important thing findings?

Fairness Returns: The Twentieth-century fairness premium (particularly within the U.S.) was abnormally excessive, starting from 4–6% over bonds. In distinction, Nineteenth-century fairness premia had been near zero and even destructive in some datasets.

Bond Yields: Bond yields had been traditionally a lot increased—even throughout instances of low progress and inflation (pre-1900s)—and the ultra-low yields within the 2000s and 2010s had been traditionally unprecedented.

Credit score Premia: Lengthy-run extra returns on company bonds over authorities bonds are small (about 0.75%–1%) and tough to estimate reliably because of restricted pre-Seventies knowledge.

Actual Property: Whereas actual property is necessary for family wealth, long-run complete returns (together with rental earnings) seem decrease than equities, particularly after adjusting for prices and high quality enhancements.

Commodities: Whereas spot commodity investments have low or destructive actual returns, diversified portfolios of commodity futures have traditionally earned a 3–4% annual premium, largely because of diversification and rebalancing results.

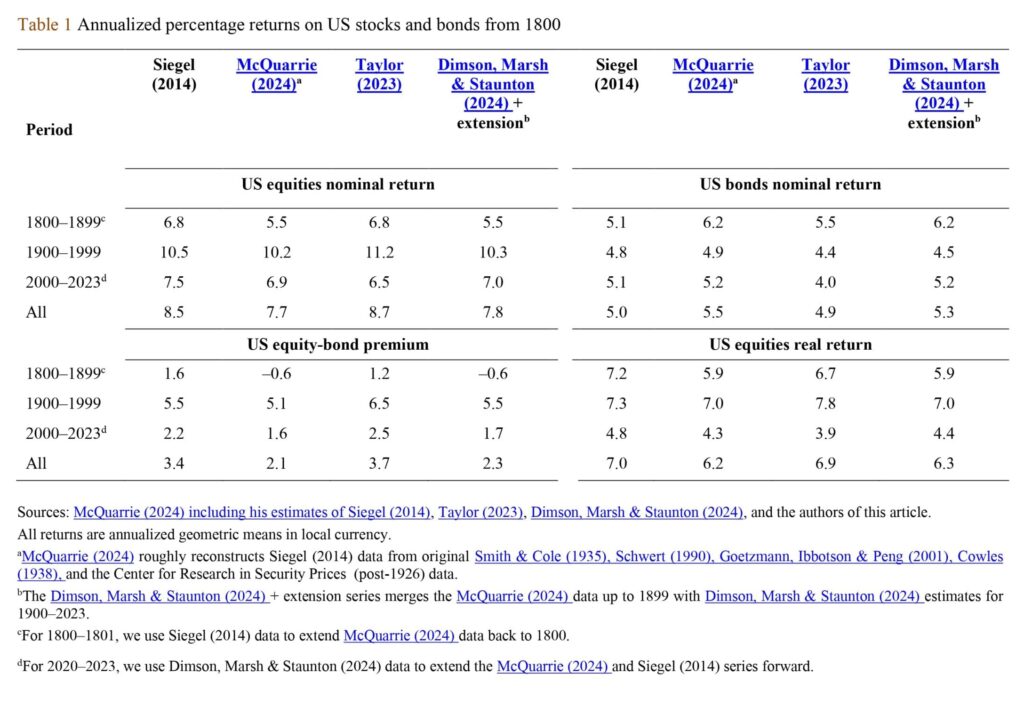

To supply a complete understanding of long-run asset returns, we encourage readers to look at Determine 1, which illustrates that commodity futures have nearly matched the long-run returns of US equities over a 152-year window and even exceeded fairness funding returns since 1900. Moreover, Desk 1 summarizes the annualized nominal returns of equities and bonds, the fairness threat premium over bonds, and the annualized actual returns of equities throughout 1800–1899, 1900–1999, and 2000–2023. Notably, the figures introduced are geometric means (compound returns), sometimes decrease than arithmetic means (easy returns), particularly for extra risky sequence.

Authors: David Chambers, Elroy Dimson, Antti Ilmanen, Paul Rintamäki

Title: Lengthy-Run Asset Returns

Hyperlink: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5022480

Summary:

The literature on long-run asset returns has continued to develop steadily, significantly because the begin of the brand new millennium. We survey this increasing physique of proof on historic return premia throughout the foremost asset classes-stocks, bonds, and actual assets-over the very long term. As well as, we talk about the advantages and pitfalls of those long-run knowledge units and make solutions on finest follow in compiling and utilizing such knowledge. We report the magnitude of those threat premia over the present and former two centuries, and we evaluate estimates from different knowledge compilers. We conclude by proposing some promising instructions for future analysis.

As frequently, we current a number of attention-grabbing figures and tables:

Notable quotations from the tutorial analysis paper:

“First, we tackle one of many central questions in empirical asset pricing, particularly, whether or not shares persistently beat bonds in the long term. A lot of this proof relies on research of information sequence beginning in 1900, or notably, 1926, within the case of US shares and bonds—the beginning date of the CRSP (Heart for Analysis in Safety Costs) knowledge set. The selection of begin date issues. The proof relating to common returns drawn from post-1900/1926 research delivered the standard knowledge that the long-run fairness threat premium over bonds was considerably constructive in america and in each different nation with a protracted historical past. Nevertheless, in returning to this query, we study the pre-1900/1926 historical past of inventory and bond returns—primarily in america and the UK. The proof means that the hole between the typical returns on shares and on bonds was low in the UK and seemingly negligible in america.

Second, we study simply how abnormally low bond yields had been within the two opening a long time of the twenty-first century. When viewing the yields of presidency bonds (or different bonds with a low credit score threat) in a a lot longer-run perspective, we conclude that current yield expertise was certainly unprecedented.The third query considerations company bonds and the credit score threat premium. The prevailing proof on the extent of the surplus returns or premia attributable to credit score threat relies on a comparatively brief historical past stretching again to the Seventies. We subsequently ask whether or not (or not) long-horizon company bond knowledge histories can present insights on credit score extra returns. Briefly, the proof is at finest combined because of estimation issues and a paucity of information.

Our two remaining questions take care of actual belongings—actual property and commodities—and the way compelling their long-run returns have been in comparison with equities. When reviewing the proof on the funding efficiency of actual property, we talk about the challenges introduced by the heterogeneity and immovability of this asset class. The proof has largely targeted on housing and means that complete returns are beneath these from equities. We then flip to commodities and critically study the claims of the current research pointing to surprisingly excessive long-run returns. Right here, we conclude that the long-run historic returns on a diversified portfolio of futures have come near approximating these on equities.

To sum up, the fairness threat premium was exceptionally excessive within the twentieth century, whereas being low within the nineteenth century—notably in america. The explanations for these variations are worthy of additional analysis. Each centuries might have been irregular. According to this, main specialists at a current fairness premium symposium estimated a potential equity-bond premium of between 0% and 5% (Siegel & McCaffrey 2023, appendix A). The most effective steering on future premia could also be between the expertise of the fortunate 1900s and that of the disappointing 1800s.

This obvious puzzle of excessive actual rates of interest in a slow-growth world could also be defined by capital shortage, the impatience of savers at a time when most individuals lived close to subsistence degree, in addition to excessive monetary intermediation prices (Bernstein 2022). Most economists finding out the elemental determinants of actual rates of interest have targeted on the anticipated consumption progress price moderately than time choice. Whereas that is acceptable within the fashionable world, it appears much less so in preindustrial instances. Rogoff, Rossi & Schmelzing (2024) explored the Schmelzing knowledge for structural breaks however discover none after the Industrial Revolution; as a substitute, actual yields are pattern stationary. Like us, the authors spotlight opposing tendencies in actual yields and actual progress throughout centuries.12

Our last phrase on actual property is an attraction for extra long-run empirical research of complete returns to housing utilizing the most effective accessible knowledge and avoiding the measurement issues highlighted above. It’s also price emphasizing that little has been executed on the long-run efficiency of business actual property, farmland, and infrastructure.21 That is significantly necessary given their larger relevance to institutional investor portfolios than housing.

Summarizing, the historic proof means that whereas single commodities will not be anticipated to outperform money in compound returns, a diversified commodity futures portfolio can provide an anticipated premium of three–4% every year. Moreover, it has achieved this over lengthy durations—whether or not the previous 150, 100, or 50 years. Total, we conclude that this diversification return is an important and empirically strong contributor to the constructive long-term commodity premium.25”

Are you in search of extra methods to examine? Join our e-newsletter or go to our Weblog or Screener.

Do you need to study extra about Quantpedia Premium service? Test how Quantpedia works, our mission and Premium pricing provide.

Do you need to study extra about Quantpedia Professional service? Test its description, watch movies, assessment reporting capabilities and go to our pricing provide.

Are you in search of historic knowledge or backtesting platforms? Test our checklist of Algo Buying and selling Reductions.

Or observe us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookConfer with a good friend