Divergence in buying and selling refers back to the situation when there’s a discrepancy between a inventory’s value motion and its momentum indicators (mostly the RSI and the MACD).

First, we have to absolutely perceive the idea of standard divergence earlier than studying the brand new topic of hidden divergence.

In each instances, you have to have a pattern earlier than in search of divergences.

Contents

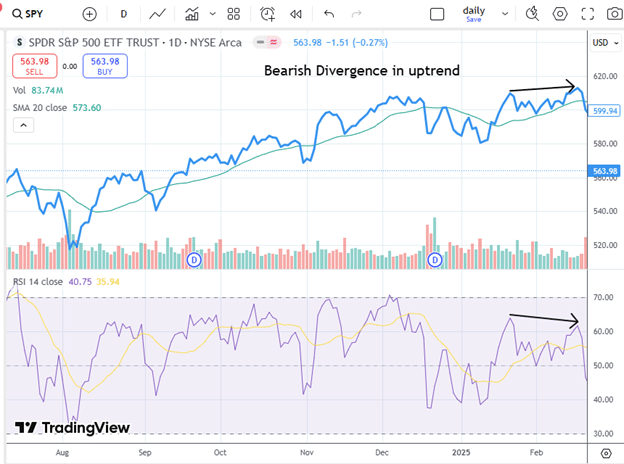

Take into account the next line chart (so we are able to see higher the peaks and valleys) of SPY in the course of the uptrend in early 2025.

Trying on the value peaks, we see that it made a better peak (because it ought to have if it was in an uptrend).

Nevertheless, the RSI momentum has not confirmed this.

RSI made a decrease peak on the identical time.

The shift is refined, however it is a discrepancy between the worth and momentum.

This means that the momentum of the uptrend could also be slowing down.

This is named bearish divergence as a result of it’s believed that the worth will quickly observe the bearishness of the momentum and switch downwards.

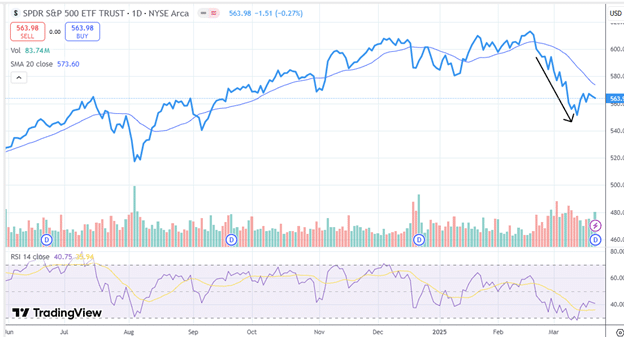

On this case, it did occur”:

Free Earnings Season Mastery eBook

Nevertheless, we have to do not forget that bearish divergence doesn’t essentially imply the worth will go down.

It simply means being looking out for the uptrend to decelerate.

It might imply that the worth will transfer sideways for some time.

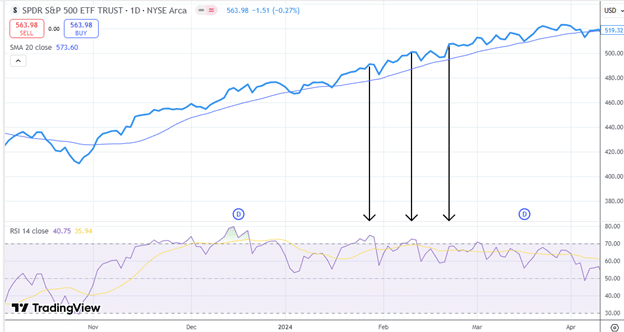

Right here, in the identical asset, we are able to see bearish divergences the place the worth peaks are making increased highs whereas the RSI peaks are making decrease highs:

But the worth continues to go up regardless of this, exhibiting us that bearish divergence alerts don’t at all times work.

Usually, the peaks and valleys of value ought to correspond to the peaks and valleys of momentum.

When in search of hidden divergences in an uptrend, we have a look at the valleys (as a substitute of the peaks).

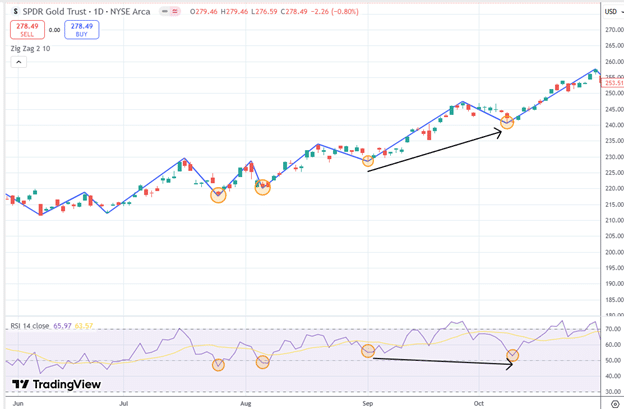

Right here, we see GLD (gold ETF) in late 2024 with the ZigZag instrument turned on.

The primary three highlighted valleys present costs going up.

So are the three corresponding valleys of RSI.

Issues are as they need to be.

The subsequent valley within the value chart continues to go increased.

Nevertheless, the fourth valley in RSI is decrease than the third valley in RSI. Issues will not be as they need to be.

RSI exhibits a hidden divergence from what the worth is doing.

This suggests that the worth will proceed its upward trajectory.

Certainly, we see that the worth continues its upward trajectory after seeing this “bullish hidden divergence.”

We name this “bullish” hidden divergence as a result of it implies an upward motion in value.

We are saying “bullish” or “bearish” divergences and hidden divergences as to what the sign implies the worth will do.

Be aware that you could be additionally see the phrases “constructive” or “unfavourable” as being synonymous with “bullish” and “bearish,” respectively.

For among the readers, hidden divergence could seem counter-intuitive.

If momentum is reducing, why would the worth proceed up?

It helps to reframe the pondering for hidden divergences.

Momentum is decrease, but some forces are stronger than momentum, supporting increased costs.

This drive carries the worth additional up.

That is very true in case you see the valleys of the RSI, each nonetheless above 50.

An RSI above 50 is bullish, and an RSI under 50 is bearish.

RSI has additionally been referred to as an oversold and overbought indicator. The fourth RSI valley signifies that the worth is “extra oversold” than the earlier RSI valley, and therefore, it’s a good purchase for bulls.

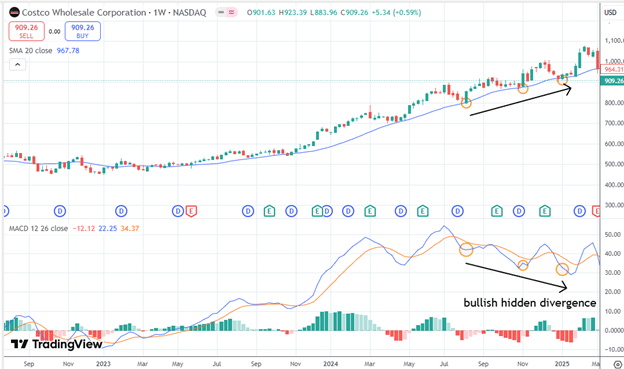

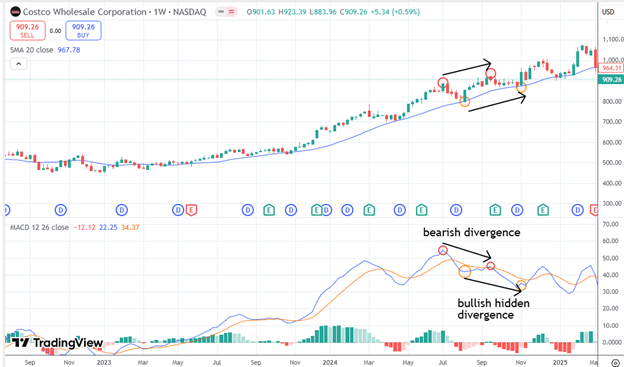

Beneath, we use MACD (as a substitute of RSI) because the momentum indicator on a weekly chart of Costco (COST), which is in an uptrend.

This exhibits that this idea works on any timeframe and could be utilized to different momentum indicators.

We see a collection of upper valleys in value with decrease valleys in MACD.

This can be a bullish hidden divergence suggesting a continuation of upward-moving costs.

The astute reader might say:

However wait, I see a bearish divergence on the identical chart

A bearish divergence suggests costs go down.

A bullish hidden divergence suggests costs to go up.

Which is it going to be?

Some merchants discover the hidden divergence sign to be extra highly effective.

Why?

As a result of the hidden divergence sign provides a sign within the course of the pattern. In the meantime, the divergence sign is a counter-trend sign.

The chart is in an uptrend, and the bullish hidden divergence sign suggests the continuation of that pattern.

Nothing in buying and selling is black and white.

Divergences and hidden divergences are only one consideration many merchants will use to watch the worth.

On this article, we gave solely eventualities for an uptrend.

As a result of the market is shifting up more often than not, we imagine you need to perceive these ideas for an uptrending market earlier than switching the pondering to a downtrending market, which we’ll cowl partly 2.

We hope you loved this text on divergence and hidden divergence.

You probably have any questions, ship an e-mail or depart a remark under.

Commerce secure!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who will not be accustomed to trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.