Up to date on September eleventh, 2025 by Bob Ciura

Shares with low P/E ratios can provide enticing returns if their valuation multiples broaden.

And when a low P/E inventory additionally has a excessive dividend yield, traders get ‘paid to attend’ for the valuation a number of to extend.

We outline a high-yield inventory as one with a present dividend yield of 5% or larger.

The free excessive dividend shares checklist spreadsheet beneath has our full checklist of particular person securities (shares, REITs, MLPs, and so forth.) with with 5%+ dividend yields.

You possibly can obtain a free copy by clicking on the hyperlink beneath:

On this analysis report, we focus on the prospects of 20 undervalued excessive dividend shares, that are at the moment buying and selling at P/E ratios below 10 and are providing dividend yields above 5.0%.

Worldwide shares have been excluded from this report.

We’ve ranked the shares by P/E ratio, from lowest to highest. For REITs, we use P/FFO instead of the P/E ratio. And for MLPs, we use P/DCF (which is distributable money flows).

These are comparable metrics much like earnings for widespread shares.

These 20 dividend shares haven’t been screened for dividend security. As an alternative, these are the 20 most undervalued shares within the Positive Evaluation Analysis Database with excessive dividend yields.

Desk of Contents

Hold studying to see evaluation on these 20 undervalued excessive dividend shares.

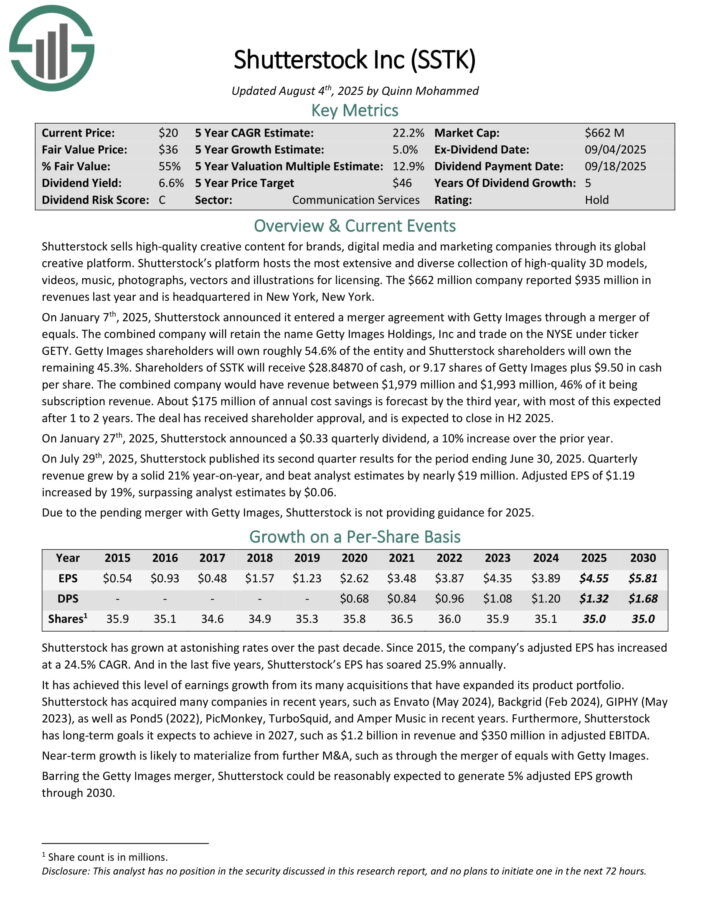

Undervalued Excessive Dividend Inventory #1: Shutterstock, Inc. (SSTK) – P/E ratio of 4.4

Shutterstock sells high-quality artistic content material for manufacturers, digital media and advertising firms via its international artistic platform.

Its platform hosts essentially the most intensive and numerous assortment of high-quality 3D fashions, movies, music, images, vectors and illustrations for licensing. The corporate reported $935 million in revenues final 12 months.

On January seventh, 2025, Shutterstock introduced it entered a merger settlement with Getty Photographs via a merger of equals. The mixed firm will retain the title Getty Photographs Holdings, Inc and commerce on the NYSE below ticker GETY.

Getty Photographs shareholders will personal roughly 54.6% of the entity and Shutterstock shareholders will personal the remaining 45.3%. Shareholders of SSTK will obtain $28.84870 of money, or 9.17 shares of Getty Photographs plus $9.50 in money per share.

The mixed firm would have income between $1,979 million and $1,993 million, 46% of it being subscription income. About $175 million of annual value financial savings is forecast by the third 12 months, with most of this anticipated after 1 to 2 years.

On July twenty ninth, 2025, Shutterstock revealed its second quarter outcomes for the interval ending June 30, 2025. Quarterly income grew by a stable 21% year-on-year, and beat analyst estimates by practically $19 million. Adjusted EPS of $1.19 elevated by 19%, surpassing analyst estimates by $0.06.

Click on right here to obtain our most up-to-date Positive Evaluation report on SSTK (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #2: Jackson Monetary (JXN) – P/E ratio of 4.6

Jackson Monetary primarily presents annuity merchandise to retail traders in the US. The corporate operates in three segments and supplies a variety of retirement earnings and financial savings choices.

The Institutional Merchandise phase consists of conventional funding contracts and funding agreements. The Closed Life and Annuity Blocks phase presents varied insurance coverage merchandise. The corporate distributes its choices via a various community of monetary intermediaries.

On August fifth, 2025, the corporate introduced outcomes for the second quarter of 2025. Jackson Monetary reported non GAAP EPS of $4.87, which beat estimates by $0.23.

Variable annuity gross sales dipped to $2.5 billion, reflecting decrease lifetime profit product gross sales, whereas registered index linked annuity (RILA) gross sales got here in at $1.4 billion, which was barely beneath final 12 months. Fastened and stuck index annuity gross sales, nonetheless, surged to $470 million, supported by enhanced asset sourcing at PPM America.

The corporate posted internet earnings of $168 million, or $2.34 per diluted share, in comparison with $264 million, or $3.43 per diluted share, a 12 months in the past.

Adjusted working earnings of $350 million have been down from $410 million within the prior 12 months, primarily reflecting decrease payment earnings tied to decreased variable annuity AUM.

Capital power remained a standout, with Jackson’s risk-based capital ratio at 566% and whole adjusted capital above $5.3 billion. Free money stream reached $290 million within the quarter, contributing to over $1 billion over the trailing twelve months.

Click on right here to obtain our most up-to-date Positive Evaluation report on JXN (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #3: ARMOUR Residential REIT (ARR) – P/E ratio of 4.9

ARMOUR Residential invests in residential mortgage-backed securities that embrace U.S. Authorities-sponsored entities (GSE) equivalent to Fannie Mae and Freddie Mac.

It additionally consists of Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate residence loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different kinds of investments.

On July 23, 2025, ARMOUR Residential REIT, Inc. reported its monetary outcomes for the second quarter of 2025. ARMOUR Residential REIT, Inc. reported a GAAP internet lack of $78.6 million, or $0.94 per widespread share, for Q2 2025, in comparison with a internet earnings of $24.3 million, or $0.32 per share, in Q1 2025. Web curiosity earnings was $33.1 million, down from $36.3 million within the prior quarter, with an financial internet curiosity unfold of 1.82%.

Distributable Earnings obtainable to widespread stockholders have been $64.9 million, or $0.77 per share, barely up from $64.6 million, or $0.86 per share, in Q1. The corporate raised $104.6 million by issuing 6,303,710 widespread shares and paid $0.72 per share in dividends for the quarter.

E-book worth per widespread share decreased to $16.90 from $18.59 at March 31, 2025, leading to a complete financial return of -5.22%. The portfolio totaled $15.4 billion, primarily Company MBS at 94.1%, with a debt-to-equity ratio of seven.72:1 and liquidity of $772.9 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #4: Western Union Firm (WU) – P/E ratio of 5.0

The Western Union Firm is the world chief within the enterprise of home and worldwide cash transfers. The corporate has a community of roughly 550,000 brokers globally and operates in additional than 200 nations.

About 90% of brokers are exterior of the US. Western Union operates two enterprise segments, Shopper-to-Shopper (C2C) and Different (invoice funds within the US and Argentina).

Western Union reported Q1 2025 outcomes on August 4th, 2025. Firm-wide income decreased 4% and diluted GAAP earnings per share decreased 10% to $0.37 within the quarter in comparison with $0.41 within the prior 12 months on decrease income, larger curiosity expense and tax charge.

Income declined due to challenges in Iraq and a slowdown in North American retail, offset by larger Banded Digital transactions and power in Shopper Providers.

CMT income fell 8% to $885M from $965M on a year-over-year foundation due to 2% decrease transaction volumes. Branded Digital Cash Switch CMT revenues elevated 6% as transactions rose 9%. Digital income is now 29% of whole CMT income and 36% of transactions.

Click on right here to obtain our most up-to-date Positive Evaluation report on WU (preview of web page 1 of three proven beneath):

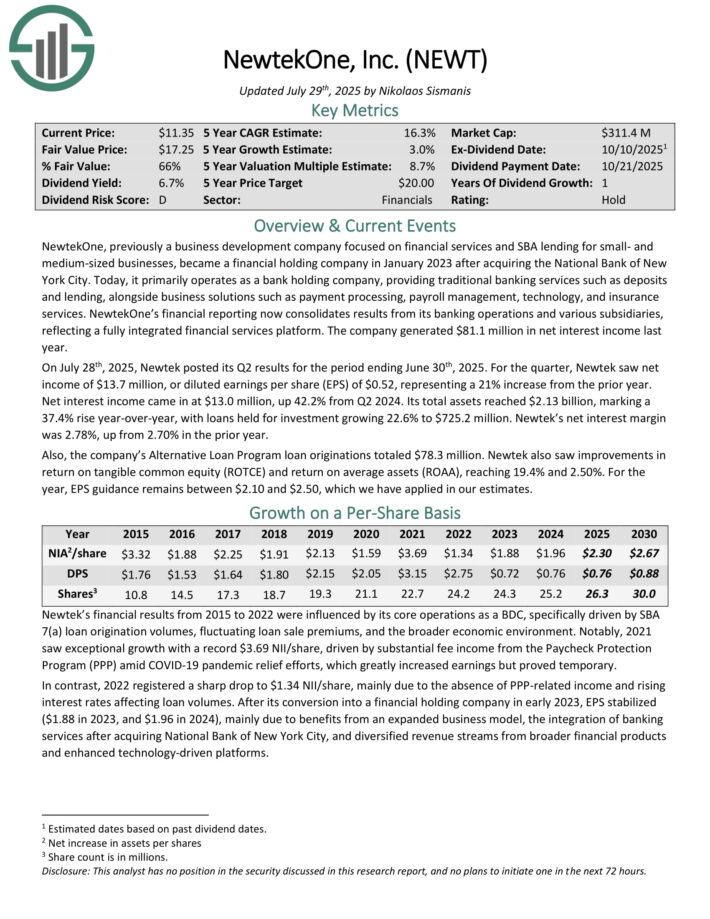

Undervalued Excessive Dividend Inventory #5: NewtekOne Inc. (NEWT) – P/E ratio of 5.0

NewtekOne, beforehand a enterprise growth firm centered on monetary companies and SBA lending for small- and medium-sized companies, turned a monetary holding firm in January 2023 after buying the Nationwide Financial institution of New York Metropolis.

As we speak, it primarily operates as a financial institution holding firm, offering conventional banking companies equivalent to deposits and lending, alongside enterprise options equivalent to cost processing, payroll administration, know-how, and insurance coverage companies.

NewtekOne’s monetary reporting now consolidates outcomes from its banking operations and varied subsidiaries, reflecting a totally built-in monetary companies platform. The corporate generated $81.1 million in internet curiosity earnings final 12 months.

On July twenty eighth, 2025, Newtek posted its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, Newtek noticed internet earnings of $13.7 million, or diluted earnings per share (EPS) of $0.52, representing a 21% improve from the prior 12 months.

Web curiosity earnings got here in at $13.0 million, up 42.2% from Q2 2024. Its whole property reached $2.13 billion, marking a 37.4% rise year-over-year, with loans held for funding rising 22.6% to $725.2 million. Newtek’s internet curiosity margin was 2.78%, up from 2.70% within the prior 12 months.

Additionally, the corporate’s Different Mortgage Program mortgage originations totaled $78.3 million. Newtek additionally noticed enhancements in return on tangible widespread fairness (ROTCE) and return on common property (ROAA), reaching 19.4% and a pair of.50%.

Click on right here to obtain our most up-to-date Positive Evaluation report on NEWT (preview of web page 1 of three proven beneath):

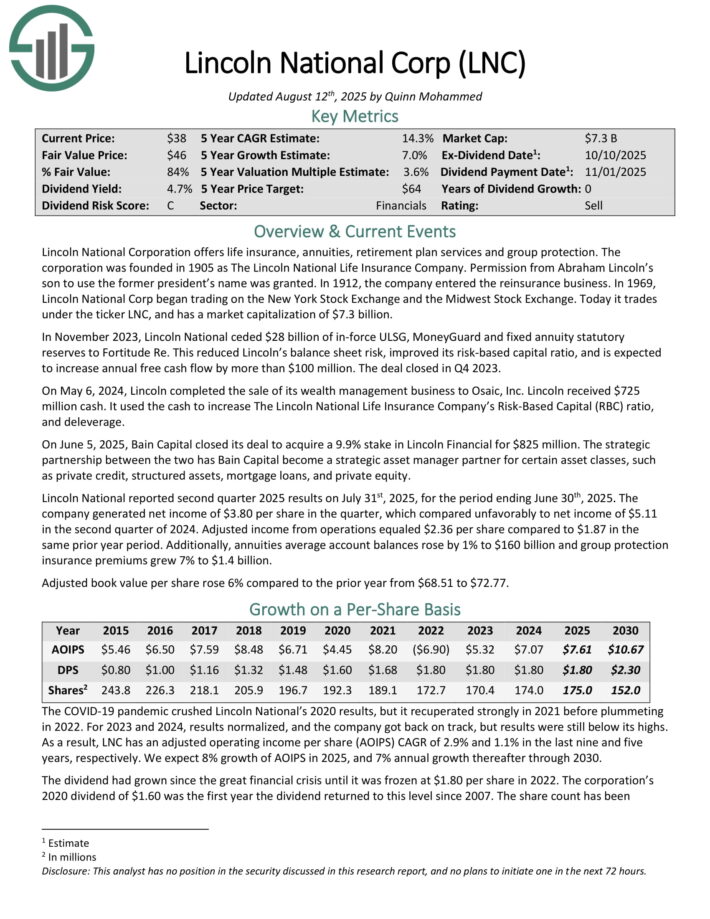

Undervalued Excessive Dividend Inventory #6: Lincoln Nationwide (LNC) – P/E ratio of 5.5

Lincoln Nationwide Company presents life insurance coverage, annuities, retirement plan companies and group safety.

On June 5, 2025, Bain Capital closed its deal to amass a 9.9% stake in Lincoln Monetary for $825 million. The strategic partnership between the 2 has Bain Capital grow to be a strategic asset supervisor companion for sure asset courses, equivalent to non-public credit score, structured property, mortgage loans, and personal fairness.

Lincoln Nationwide reported second quarter 2025 outcomes on July thirty first, 2025. The corporate generated internet earnings of $3.80 per share within the quarter, which in contrast unfavorably to internet earnings of $5.11 within the second quarter of 2024. Adjusted earnings from operations equaled $2.36 per share in comparison with $1.87 in the identical prior 12 months interval.

Moreover, annuities common account balances rose by 1% to $160 billion and group safety insurance coverage premiums grew 7% to $1.4 billion. Adjusted ebook worth per share rose 6% in comparison with the prior 12 months from $68.51 to $72.77.

Click on right here to obtain our most up-to-date Positive Evaluation report on LNC (preview of web page 1 of three proven beneath):

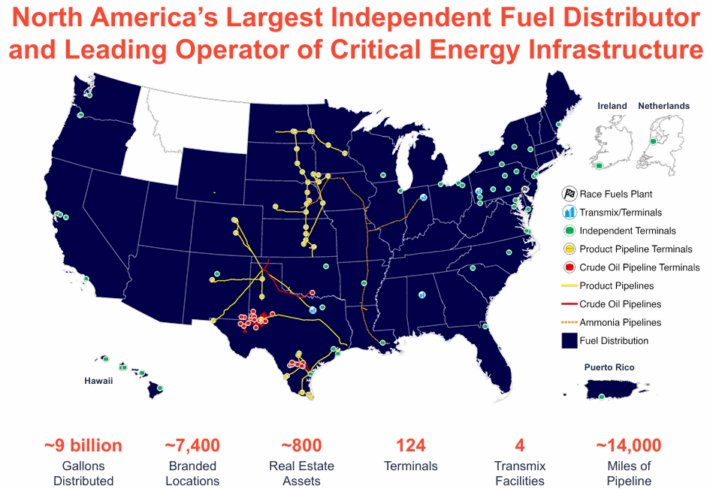

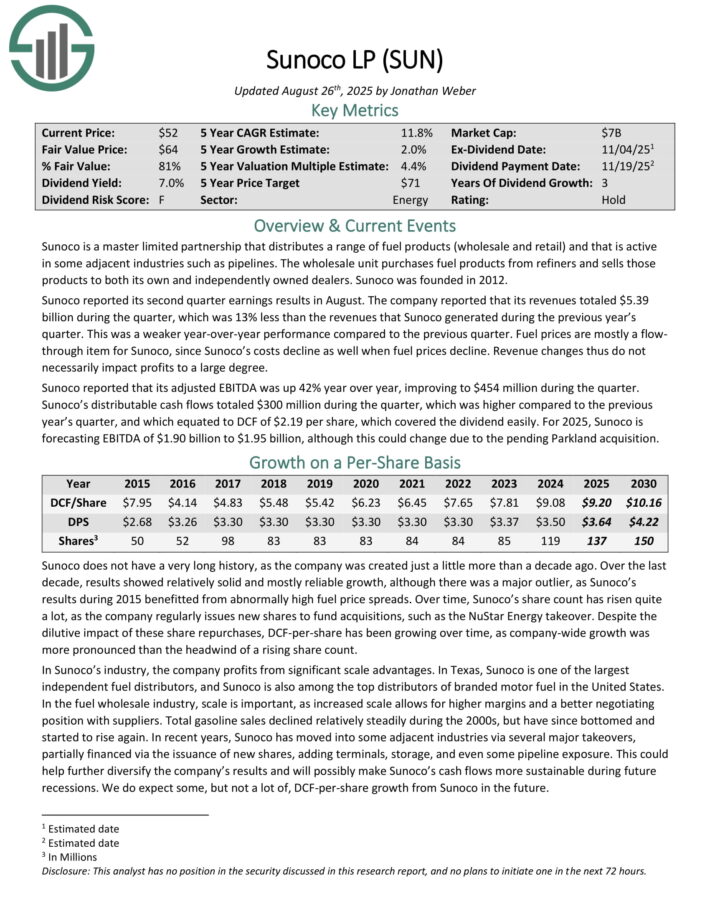

Undervalued Excessive Dividend Inventory #7: Sunoco LP (SUN) – P/E ratio of 5.5

Sunoco is a grasp restricted partnership that distributes a variety of gas merchandise (wholesale and retail) and that’s energetic in some adjoining industries equivalent to pipelines.

The wholesale unit purchases gas merchandise from refiners and sells these merchandise to each its personal and independently owned sellers.

Supply: Investor Presentation

Sunoco reported its second quarter earnings leads to August. The corporate reported that its revenues totaled $5.39 billion through the quarter, which was 13% lower than the revenues that Sunoco generated through the earlier 12 months’s quarter.

This was a weaker year-over-year efficiency in comparison with the earlier quarter. Gas costs are principally a stream via merchandise for Sunoco, since Sunoco’s prices decline as effectively when gas costs decline. Income adjustments thus don’t essentially affect earnings to a big diploma.

Sunoco reported that its adjusted EBITDA was up 42% 12 months over 12 months, enhancing to $454 million through the quarter. Sunoco’s distributable money flows totaled $300 million through the quarter. This was larger in comparison with the earlier 12 months’s quarter, and equated to DCF of $2.19 per share, which coated the dividend simply.

Click on right here to obtain our most up-to-date Positive Evaluation report on SUN (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #8: Somerset Belief Holding Firm (SOME) – P/E ratio of 5.7

Somerset Belief Holding Firm, based in 1889 and headquartered in Somerset, Pennsylvania, is a regional financial institution with 44 branches throughout Pennsylvania, Maryland, and Virginia.

The corporate supplies a full suite of monetary companies, together with private and enterprise banking, wealth administration, loans, and investments, with a robust dedication to community-driven banking.

In 2023, the financial institution launched a brand new digital banking platform to boost buyer comfort and make use of Robotic Course of Automation (RPA) to enhance operational effectivity. On the finish of March, Somerset Belief reported whole deposits of $1.94 billion and internet loans of $1.55 billion.

On August ninth, 2025, Somerset posted its Q2 outcomes for the interval ending June thirtieth, 2025. For the interval, whole curiosity and dividend earnings grew 9% to $65.6 million.

Complete curiosity bills grew 11% to $22.3 million. Web curiosity earnings grew 8% to $43.4 million. Complete different earnings (equivalent to belief division earnings and repair charges) grew 2% to $8.8 million.

Complete different bills (together with salaries, occupancy, and gear) grew 3% to $36.0 million. EPS was $4.66, up 7% from the prior 12 months’s outcome.

Click on right here to obtain our most up-to-date Positive Evaluation report on SOME (preview of web page 1 of three proven beneath):

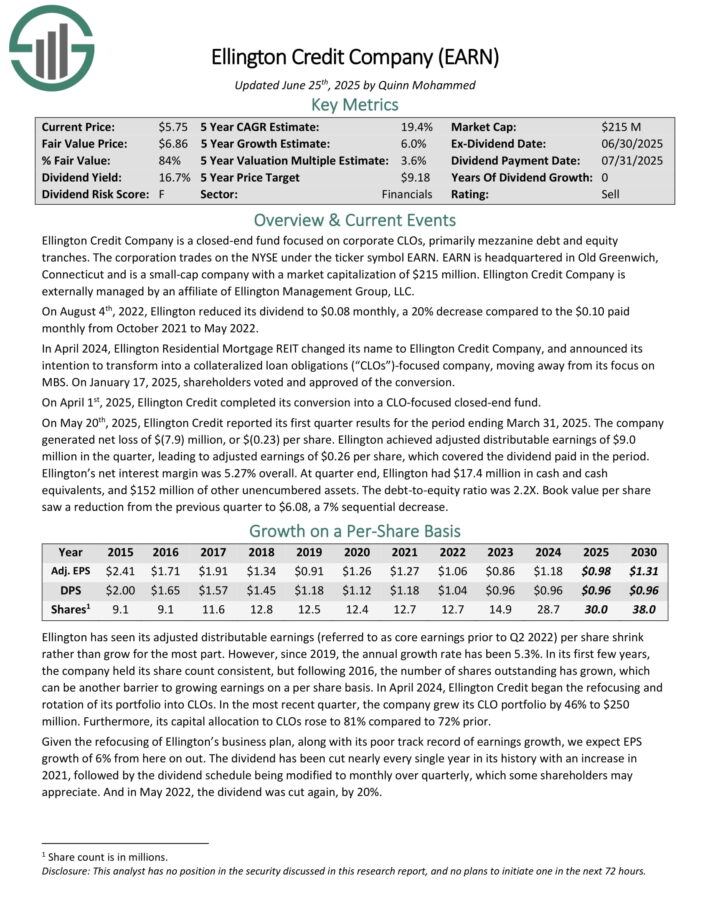

Undervalued Excessive Dividend Inventory #9: Ellington Credit score Co. (EARN) – P/E ratio of 5.8

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities businesses or enterprises, whereas non-agency MBS are not assured by the federal government.

On Could twentieth, 2025, Ellington Credit score reported its first quarter outcomes for the interval ending March 31, 2025. The corporate generated internet lack of $(7.9) million, or $(0.23) per share.

Ellington achieved adjusted distributable earnings of $9.0 million within the quarter, resulting in adjusted earnings of $0.26 per share, which coated the dividend paid within the interval.

Ellington’s internet curiosity margin was 5.27% total. At quarter finish, Ellington had $17.4 million in money and money equivalents, and $152 million of different unencumbered property.

The debt-to-equity ratio was 2.2X. E-book worth per share noticed a discount from the earlier quarter to $6.08, a 7% sequential lower.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven beneath):

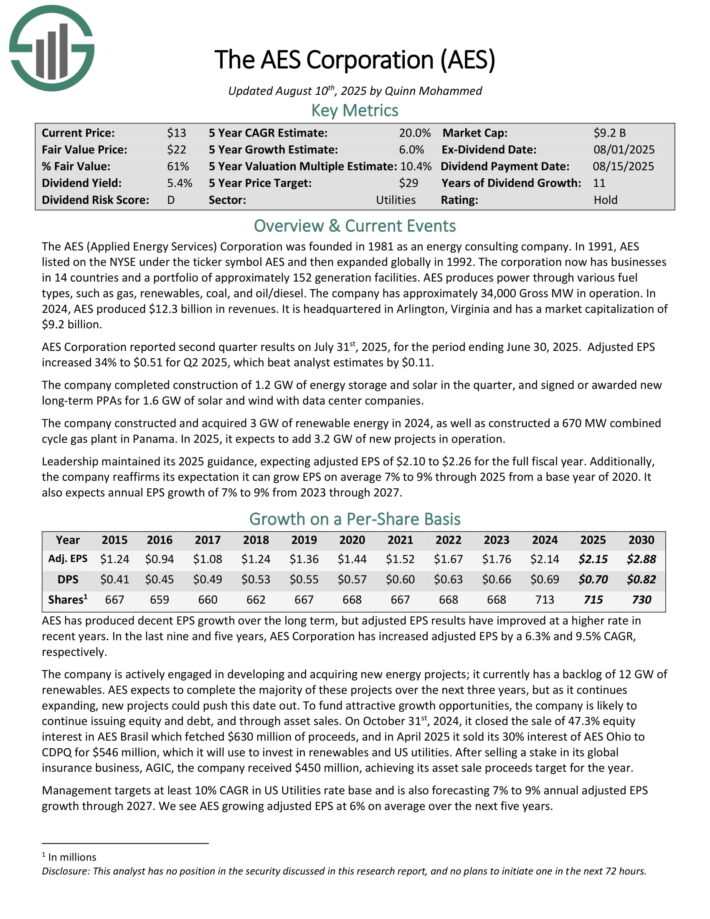

Undervalued Excessive Dividend Inventory #10: AES Corp. (AES) – P/E ratio of 5.9

The AES (Utilized Vitality Providers) Company has companies in 14 nations and a portfolio of roughly 160 era amenities. AES produces energy via varied gas varieties, equivalent to gasoline, renewables, coal, and oil/diesel.

The corporate has greater than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Company reported second quarter outcomes on July thirty first, 2025, for the interval ending June 30, 2025. Adjusted EPS elevated 34% to $0.51 for Q2 2025, which beat analyst estimates by $0.11.

The corporate accomplished building of 1.2 GW of vitality storage and photo voltaic within the quarter, and signed or awarded new long-term PPAs for 1.6 GW of photo voltaic and wind with knowledge middle firms.

The corporate constructed and purchased 3 GW of renewable vitality in 2024, in addition to constructed a 670 MW mixed cycle gasoline plant in Panama. In 2025, it expects so as to add 3.2 GW of latest tasks in operation. Management maintained its 2025 steerage, anticipating adjusted EPS of $2.10 to $2.26 for the complete fiscal 12 months.

Moreover, the corporate reaffirms its expectation it may possibly develop EPS on common 7% to 9% via 2025 from a base 12 months of 2020. It additionally expects annual EPS progress of seven% to 9% from 2023 via 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on AES (preview of web page 1 of three proven beneath):

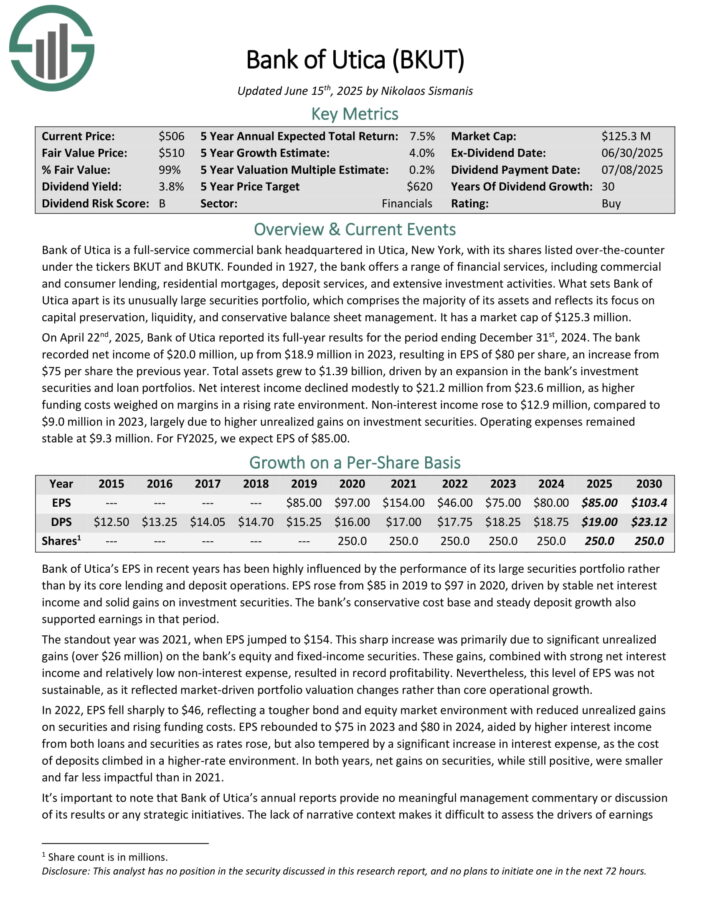

Undervalued Excessive Dividend Inventory #11: Financial institution of Utica (BKUT) – P/E ratio of 6.0

Financial institution of Utica is a full-service business financial institution headquartered in Utica, New York. Based in 1927, the financial institution presents a variety of monetary companies, together with business and client lending, residential mortgages, deposit companies, and intensive funding actions.

What units Financial institution of Utica aside is its unusually massive securities portfolio, which contains nearly all of its property and displays its give attention to capital preservation, liquidity, and conservative stability sheet administration. It has a market cap of $125.3 million.

On April twenty second, 2025, Financial institution of Utica reported its full-year outcomes for the interval ending December thirty first, 2024. The financial institution recorded internet earnings of $20.0 million, up from $18.9 million in 2023, leading to EPS of $80 per share, a rise from $75 per share the earlier 12 months.

Complete property grew to $1.39 billion, pushed by an growth within the financial institution’s funding securities and mortgage portfolios.

Web curiosity earnings declined modestly to $21.2 million from $23.6 million, as larger funding prices weighed on margins in a rising charge surroundings.

Non-interest earnings rose to $12.9 million, in comparison with $9.0 million in 2023, largely attributable to larger unrealized good points on funding securities.

Click on right here to obtain our most up-to-date Positive Evaluation report on BKUT (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #12: Horizon Expertise Finance (HRZN) – P/E ratio of 6.1

Horizon Expertise Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the know-how, life sciences, and healthcare–IT sectors.

The corporate has generated enticing danger–adjusted returns via instantly originated senior secured loans and extra capital appreciation via warrants.

On August seventh, 2025, Horizon introduced its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, whole funding earnings fell 4.5% year-over-year to $24.5 million, primarily attributable to decrease curiosity earnings on investments from the debt funding portfolio.

Extra particularly, the corporate’s dollar-weighted annualized yield on common debt investments in Q2 of 2025 and Q2 of 2024 was 15.8% and 15.9%, respectively.

Web funding earnings per share (IIS) fell to $0.28, down from $0.36 in comparison with Q2-2024. Web asset worth (NAV) per share landed at $6.75, down from $9.12 year-over-year and $8.43 sequentially.

After paying its month-to-month distributions, Horizon’s undistributed spillover earnings as of the top of the quarter was $0.94 per share, indicating a substantial money cushion. Administration assured traders of the dividend’s stability by declaring three ahead month-to-month dividends at a charge of $0.11.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRZN (preview of web page 1 of three proven beneath):

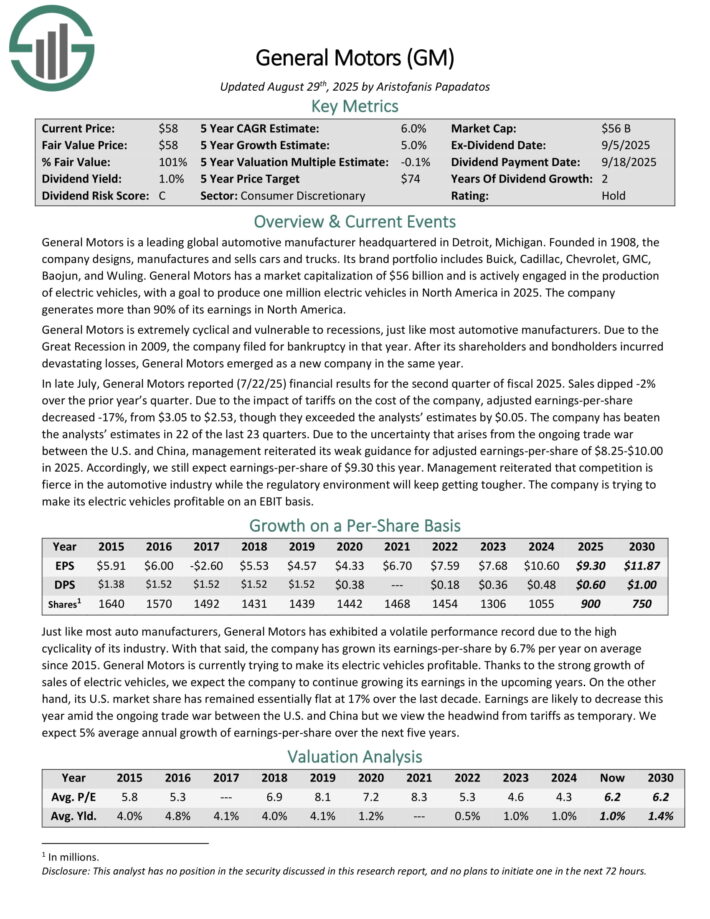

Undervalued Excessive Dividend Inventory #13: Normal Motors (GM) – P/E ratio of 6.2

Normal Motors is a number one international automotive producer headquartered in Detroit, Michigan. Based in 1908, the corporate designs, manufactures and sells automobiles and vehicles. Its model portfolio consists of Buick, Cadillac, Chevrolet, GMC, Baojun, and Wuling.

Normal Motors is actively engaged within the manufacturing of electrical autos, with a objective to provide a million electrical autos in North America in 2025. The corporate generates greater than 90% of its earnings in North America.

In late July, Normal Motors reported (7/22/25) monetary outcomes for the second quarter of fiscal 2025. Gross sales dipped -2% over the prior 12 months’s quarter. As a result of affect of tariffs on the price of the corporate, adjusted earnings-per-share decreased -17%, from $3.05 to $2.53, although they exceeded the analysts’ estimates by $0.05.

The corporate has overwhelmed the analysts’ estimates in 22 of the final 23 quarters. As a result of uncertainty that arises from the continuing commerce conflict between the U.S. and China, administration reiterated its weak steerage for adjusted earnings-per-share of $8.25-10.00 in 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on GM (preview of web page 1 of three proven beneath):

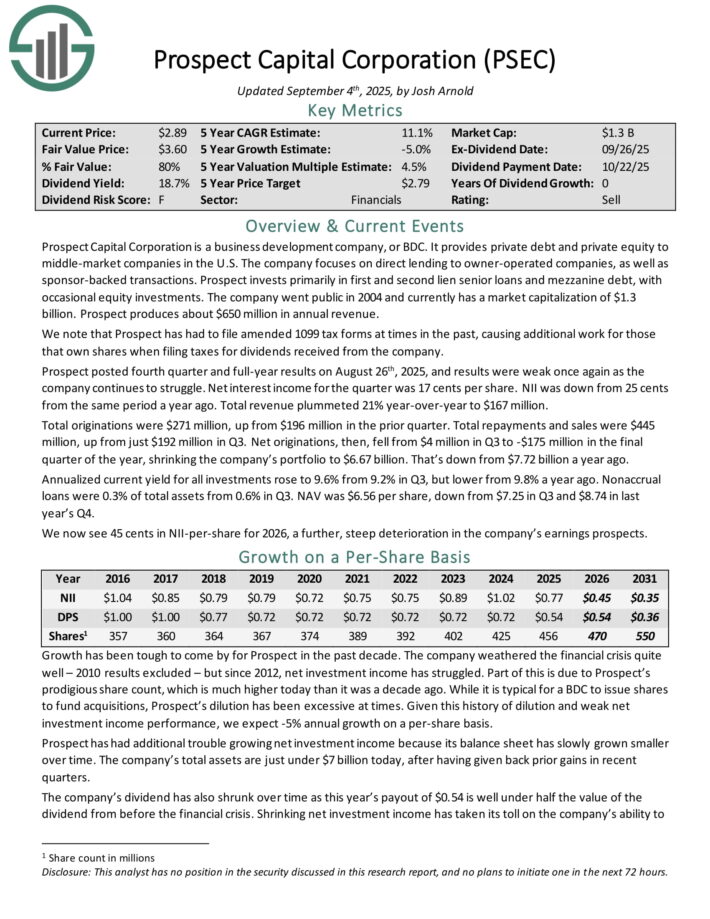

Undervalued Excessive Dividend Inventory #14: Prospect Capital (PSEC) – P/E ratio of 6.2

Prospect Capital Company is a Enterprise Improvement Firm, or BDC, that gives non-public debt and personal fairness to center–market firms within the U.S.

The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Prospect posted fourth quarter and full-year outcomes on August twenty sixth, 2025, and outcomes have been weak as soon as once more as the corporate continues to battle. Web curiosity earnings for the quarter was 17 cents per share. NII was down from 25 cents from the identical interval a 12 months in the past. Complete income plummeted 21% year-over-year to $167 million.

Complete originations have been $271 million, up from $196 million within the prior quarter. Complete repayments and gross sales have been $445 million, up from simply $192 million in Q3. Web originations, then, fell from $4 million in Q3 to -$175 million within the last quarter of the 12 months, shrinking the corporate’s portfolio to $6.67 billion. That’s down from $7.72 billion a 12 months in the past.

Annualized present yield for all investments rose to 9.6% from 9.2% in Q3, however decrease from 9.8% a 12 months in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on PSEC (preview of web page 1 of three proven beneath):

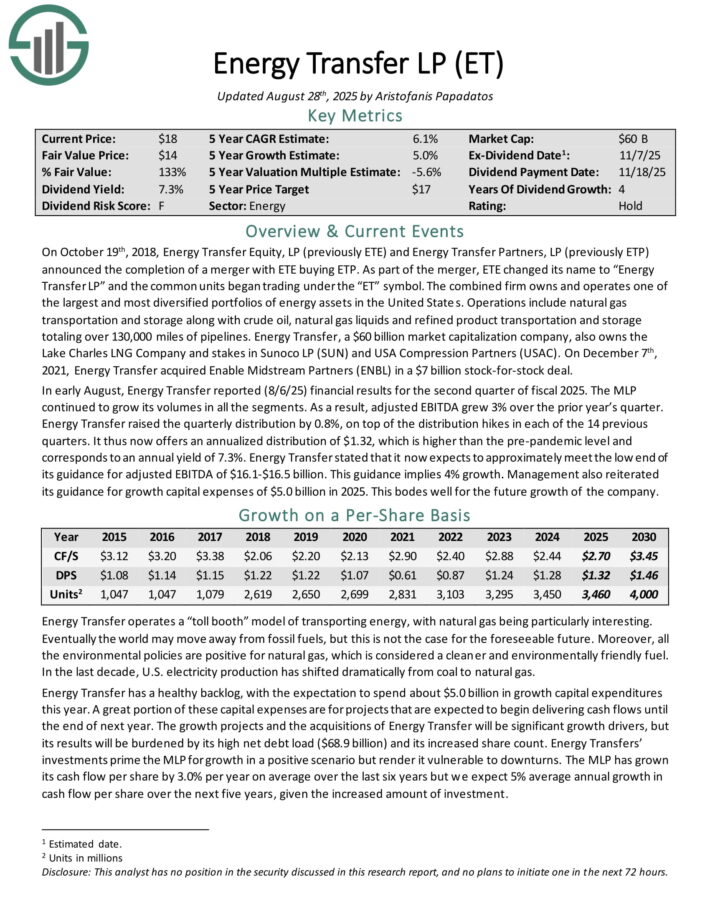

Undervalued Excessive Dividend Inventory #15: Vitality Switch LP (ET) – P/E ratio of 6.4

Vitality Switch LP owns and operates one of many largest and most diversified portfolios of vitality property in the US. Operations embrace pure gasoline transportation and storage together with crude oil, pure gasoline liquids and refined product transportation and storage totaling over 130,000 miles of pipelines.

Vitality Switch additionally owns the Lake Charles LNG Firm and stakes in Sunoco LP (SUN) and USA Compression Companions (USAC).

In early August, Vitality Switch reported (8/6/25) monetary outcomes for the second quarter of fiscal 2025. The MLP continued to develop its volumes in all of the segments. Because of this, adjusted EBITDA grew 3% over the prior 12 months’s quarter.

Vitality Switch raised the quarterly distribution by 0.8%, on prime of the distribution hikes in every of the 14 earlier quarters.

Vitality Switch acknowledged that it now expects to roughly meet the low finish of its steerage for adjusted EBITDA of $16.1-$16.5 billion. This steerage implies 4% progress.

Click on right here to obtain our most up-to-date Positive Evaluation report on ET (preview of web page 1 of three proven beneath):

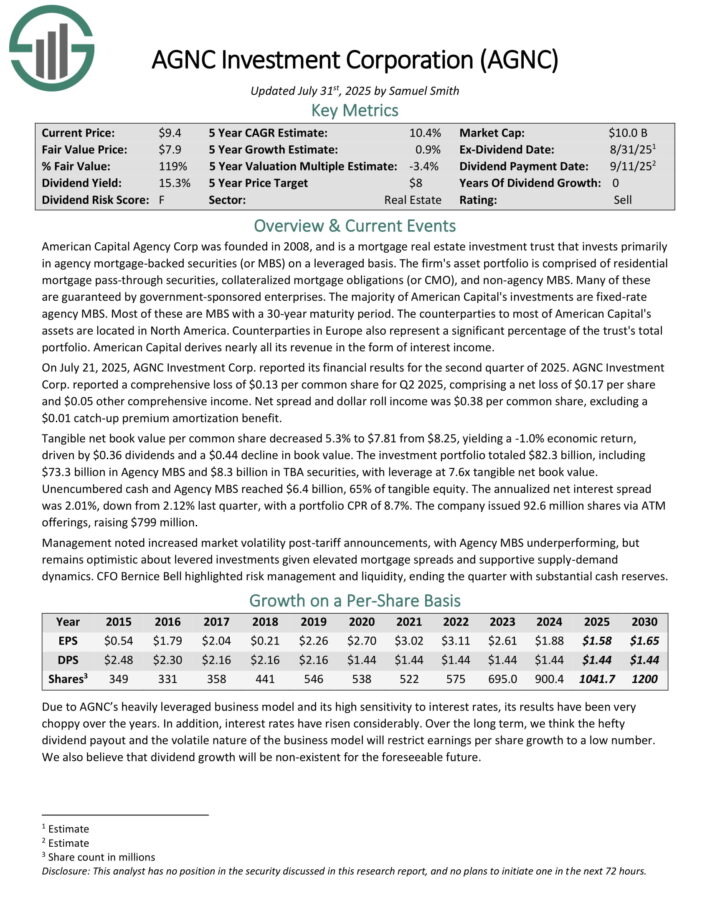

Undervalued Excessive Dividend Inventory #16: AGNC Funding Company (AGNC) – P/E ratio of 6.5

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage move–via securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

On July 21, 2025, AGNC Funding Corp. reported its monetary outcomes for the second quarter of 2025. AGNC Funding Corp. reported a complete lack of $0.13 per widespread share for Q2 2025, comprising a internet lack of $0.17 per share and $0.05 different complete earnings.

Web unfold and greenback roll earnings was $0.38 per widespread share, excluding a $0.01 catch-up premium amortization profit.

Tangible internet ebook worth per widespread share decreased 5.3% to $7.81 from $8.25, yielding a -1.0% financial return, pushed by $0.36 dividends and a $0.44 decline in ebook worth. The funding portfolio totaled $82.3 billion, together with $73.3 billion in Company MBS and $8.3 billion in TBA securities, with leverage at 7.6x tangible internet ebook worth.

Unencumbered money and Company MBS reached $6.4 billion, 65% of tangible fairness. The annualized internet curiosity unfold was 2.01%, down from 2.12% final quarter, with a portfolio CPR of 8.7%. The corporate issued 92.6 million shares through ATM choices, elevating $799 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven beneath):

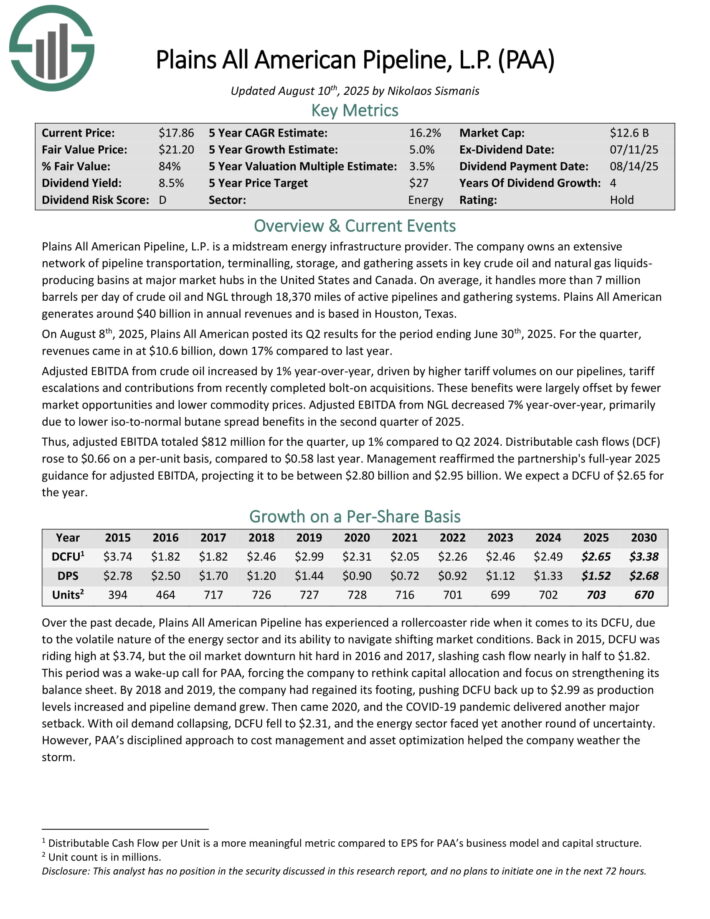

Undervalued Excessive Dividend Inventory #17: Plains All American Pipeline LP (PAA) – P/E ratio of 6.5

Plains All American Pipeline, L.P. is a midstream vitality infrastructure supplier. The corporate owns an in depth community of pipeline transportation, terminalling, storage, and gathering property in key crude oil and pure gasoline liquids producing basins at main market hubs in the US and Canada.

On common, it handles greater than 7 million barrels per day of crude oil and NGL via 18,370 miles of energetic pipelines and gathering programs. Plains All American generates round $40 billion in annual revenues and relies in Houston, Texas.

On August eighth, 2025, Plains All American posted its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, revenues got here in at $10.6 billion, down 17% in comparison with final 12 months.

Adjusted EBITDA from crude oil elevated by 1% year-over-year, pushed by larger tariff volumes on our pipelines, tariff escalations and contributions from lately accomplished bolt-on acquisitions.

These advantages have been largely offset by fewer market alternatives and decrease commodity costs. Adjusted EBITDA from NGL decreased 7% year-over-year, primarily attributable to decrease iso-to-normal butane unfold advantages within the second quarter of 2025.

Adjusted EBITDA totaled $812 million for the quarter, up 1% in comparison with Q2 2024. Distributable money flows (DCF) rose to $0.66 on a per-unit foundation, in comparison with $0.58 final 12 months. Administration reaffirmed the partnership’s full-year 2025 steerage for adjusted EBITDA, projecting it to be between $2.80 billion and $2.95 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on PAA (preview of web page 1 of three proven beneath):

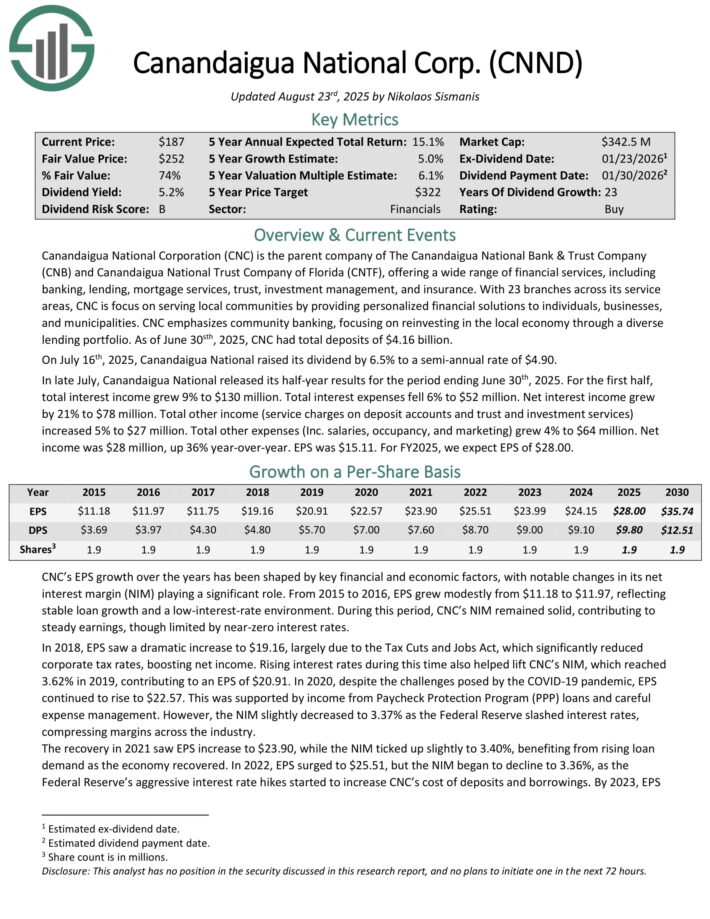

Undervalued Excessive Dividend Inventory #18: Canandaigua Nationwide Company (CNND) – P/E ratio of 6.8

Canandaigua Nationwide Company (CNC) is the mum or dad firm of The Canandaigua Nationwide Financial institution & Belief Firm (CNB) and Canandaigua Nationwide Belief Firm of Florida (CNTF), providing a variety of monetary companies, together with banking, lending, mortgage companies, belief, funding administration, and insurance coverage.

With 23 branches throughout its service areas, CNC is give attention to serving native communities by offering customized monetary options to people, companies, and municipalities.

CNC emphasizes group banking, specializing in reinvesting within the native financial system via a various lending portfolio. As of December thirty first, 2024, CNC reported whole deposits of $4.0 billion.

As of June 30sth, 2025, CNC had whole deposits of $4.16 billion. On July sixteenth, 2025, Canandaigua Nationwide raised its dividend by 6.5% to a semi-annual charge of $4.90.

In late July, Canandaigua Nationwide launched its half-year outcomes for the interval ending June thirtieth, 2025. For the primary half, whole curiosity earnings grew 9% to $130 million. Complete curiosity bills fell 6% to $52 million. Web curiosity earnings grew by 21% to $78 million.

Complete different earnings (service prices on deposit accounts and belief and funding companies) elevated 5% to $27 million. Complete different bills (Inc. salaries, occupancy, and advertising) grew 4% to $64 million. Web earnings was $28 million, up 36% year-over-year. EPS was $15.11.

Click on right here to obtain our most up-to-date Positive Evaluation report on CNND (preview of web page 1 of three proven beneath):

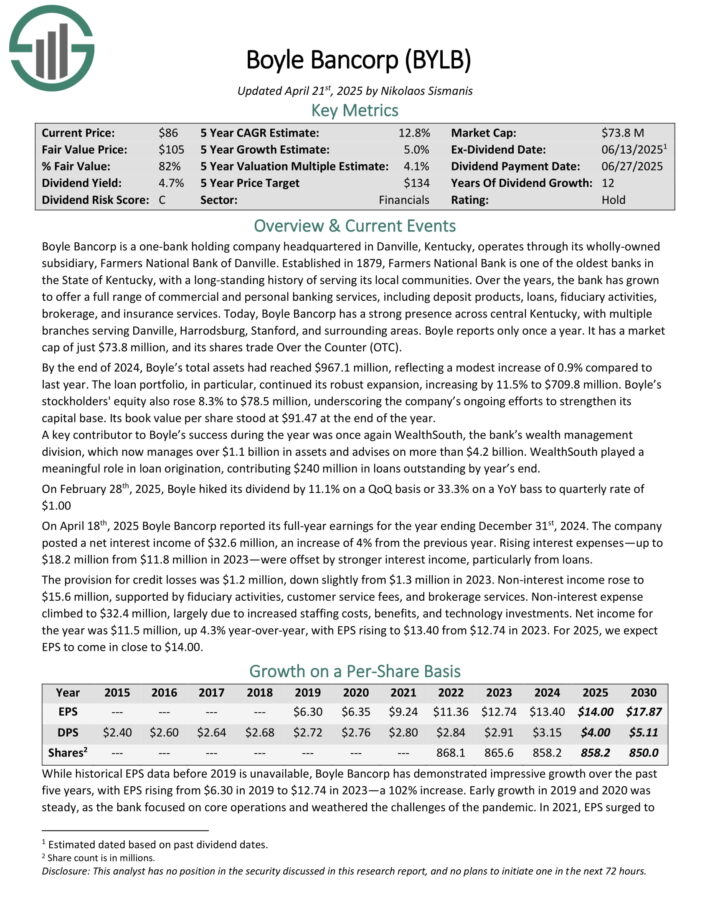

Undervalued Excessive Dividend Inventory #19: Boyle Bancorp (BYLB) – P/E ratio of 6.8

Boyle Bancorp is a one-bank holding firm headquartered in Danville, Kentucky, operates via its wholly-owned subsidiary, Farmers Nationwide Financial institution of Danville. Established in 1879, Farmers Nationwide Financial institution is likely one of the oldest banks within the State of Kentucky, with a long-standing historical past of serving its native communities.

As we speak, Boyle Bancorp has a robust presence throughout central Kentucky, with a number of branches serving Danville, Harrodsburg, Stanford, and surrounding areas. Boyle stories solely every year.

By the top of 2024, Boyle’s whole property had reached $967.1 million, reflecting a modest improve of 0.9% in comparison with final 12 months. The mortgage portfolio, particularly, continued its sturdy growth, rising by 11.5% to $709.8 million. Boyle’s stockholders’ fairness additionally rose 8.3% to $78.5 million, underscoring the corporate’s ongoing efforts to strengthen its capital base. Its ebook worth per share stood at $91.47 on the finish of the 12 months.

On April 18th, 2025 Boyle Bancorp reported its full-year earnings. The corporate posted a internet curiosity earnings of $32.6 million, a rise of 4% from the earlier 12 months. Rising curiosity bills—as much as $18.2 million from $11.8 million in 2023—have been offset by stronger curiosity earnings, notably from loans.

Click on right here to obtain our most up-to-date Positive Evaluation report on BYLB (preview of web page 1 of three proven beneath):

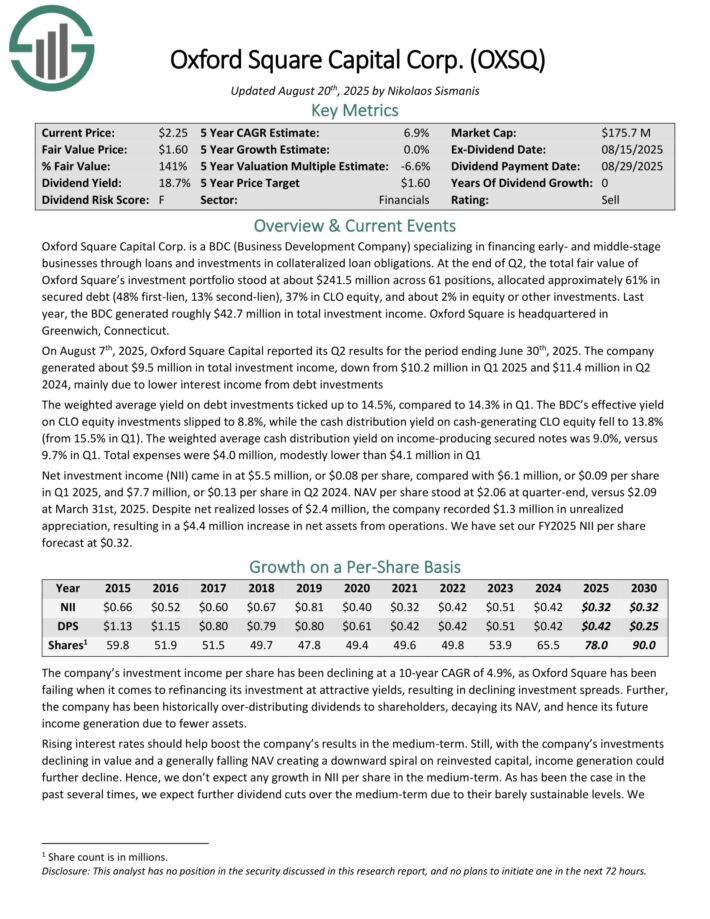

Undervalued Excessive Dividend Inventory #20: Oxford Sq. Capital (OSXQ) – P/E ratio of 6.9

Oxford Sq. Capital Corp. is a BDC (Enterprise Improvement Firm) specializing in financing early- and middle-stage companies via loans and investments in collateralized mortgage obligations.

On the finish of final quarter, the whole truthful worth of Oxford Sq.’s funding portfolio stood at about $243.2 million throughout 61 positions, allotted roughly 61% in secured debt (48% first-lien, 13% second-lien), 38% in CLO fairness, and about 1% in fairness or different investments. Final 12 months, the BDC generated roughly $42.7 million in whole funding earnings.

On August seventh, 2025, Oxford Sq. Capital reported its Q2 outcomes for the interval ending June thirtieth, 2025. The corporate generated about $9.5 million in whole funding earnings, down from $10.2 million in Q1 2025 and $11.4 million in Q2 2024, primarily attributable to decrease curiosity earnings from debt investments.

The weighted common yield on debt investments ticked as much as 14.5%, in comparison with 14.3% in Q1. The BDC’s efficient yield on CLO fairness investments slipped to eight.8%, whereas the money distribution yield on cash-generating CLO fairness fell to 13.8% (from 15.5% in Q1).

The weighted common money distribution yield on income-producing secured notes was 9.0%, versus 9.7% in Q1. Complete bills have been $4.0 million, modestly decrease than $4.1 million in Q1.

Web funding earnings (NII) got here in at $5.5 million, or $0.08 per share, in contrast with $6.1 million, or $0.09 per share in Q1 2025, and $7.7 million, or $0.13 per share in Q2 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on OXSQ (preview of web page 1 of three proven beneath):

Ultimate Ideas

All of the above shares are buying and selling at remarkably low cost valuation ranges attributable to some enterprise headwinds. A few of them have been harm by excessive inflation or the most recent financial slowdown whereas others are dealing with their very own particular points.

Furthermore, all of the above shares are providing dividend yields above 5%. Because of this, they make it a lot simpler for traders to attend patiently for the enterprise headwinds to subside.

In case you are serious about discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Positive Dividend assets shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.