Up to date on September twenty ninth, 2025 by Bob CiuraSpreadsheet knowledge up to date every day

Micro-cap shares are publicly-traded corporations with market capitalizations between $50 million and $300 million.

These characterize the smallest corporations within the inventory market.

The overall variety of micro-cap shares varies relying upon market circumstances. Proper now there are lots of of micro-cap shares, so there are loads for traders to select from.

Because the smallest shares, micro-caps might have stronger development potential over the long term than large-cap shares or mega-cap shares.

On the similar time, micro-cap shares carry quite a few distinctive danger components to think about.

You possibly can obtain a free spreadsheet of 800+ micro cap shares proper now (together with essential monetary metrics akin to price-to-earnings ratios and dividend yields) by clicking on the hyperlink beneath:

The downloadable micro-cap shares record above was curated from two main micro-cap inventory ETFs:

iShares Micro-Cap ETF (IWC)

First Belief Dow Jones Choose Micro-Cap Index Fund (FDM)

This text features a spreadsheet and desk of all of our micro-cap shares, in addition to detailed evaluation on our High 10 micro-cap shares at present.

Hold studying to see the ten finest micro-cap shares analyzed intimately.

The ten Greatest Micro Cap Shares At the moment

Now that we’ve outlined what a micro-cap inventory is, let’s check out the ten finest micro-cap shares, as outlined by our Certain Evaluation Analysis Database.

The database ranks whole anticipated annual returns, combining present yield, forecast earnings development and any change in worth from the valuation.

Notice: The Certain Evaluation Analysis Database is targeted on revenue producing securities. In consequence, we don’t observe or rank securities that don’t pay dividends. Micro-cap shares that don’t pay dividends have been excluded from the High 10 rankings beneath.

We’ve screened the micro-cap shares with the very best 5-year anticipated returns and have supplied them beneath, ranked from lowest to highest.

You possibly can immediately leap to any particular person inventory evaluation through the use of the hyperlinks beneath:

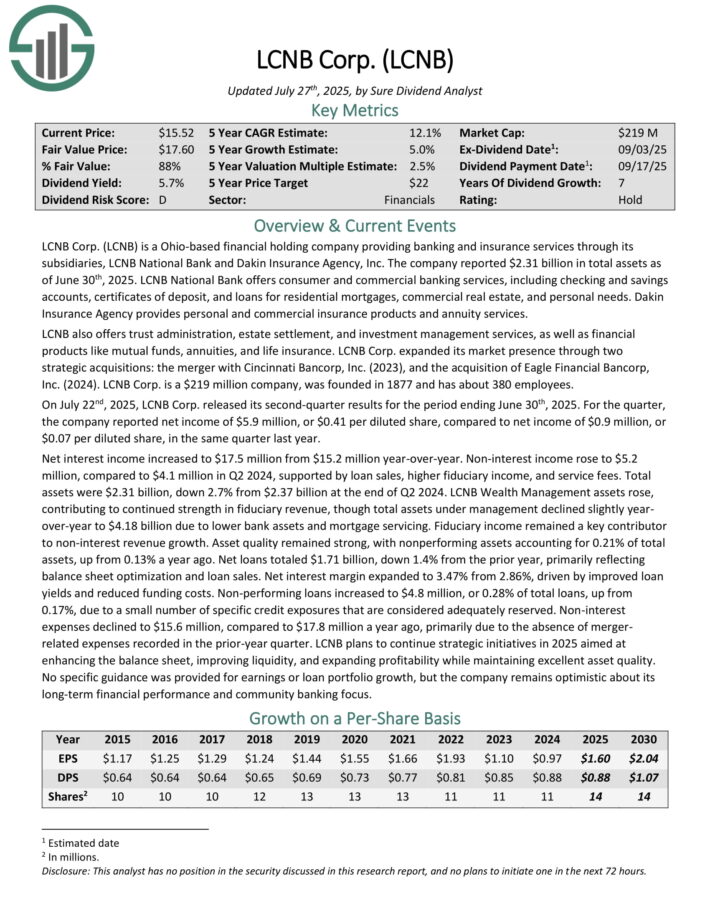

Micro Cap Inventory #10: LCNB Corp. (LCNB)

5-year anticipated annual returns: 12.0%

LCNB Corp. is a Ohio-based monetary holding firm offering banking and insurance coverage providers by means of its subsidiaries, LCNB Nationwide Financial institution and Dakin Insurance coverage Company, Inc.

The corporate reported $2.31 billion in whole property as of June thirtieth, 2025. LCNB Nationwide Financial institution provides client and business banking providers, together with checking and financial savings accounts, certificates of deposit, and loans for residential mortgages, business actual property, and private wants.

Dakin Insurance coverage Company offers private and business insurance coverage merchandise and annuity providers. LCNB additionally provides belief administration, property settlement, and funding administration providers, in addition to monetary merchandise like mutual funds, annuities, and life insurance coverage.

On July twenty second, 2025, LCNB Corp. launched its second-quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, the corporate reported internet revenue of $5.9 million, or $0.41 per diluted share, in comparison with internet revenue of $0.9 million, or $0.07 per diluted share, in the identical quarter final yr.

Internet curiosity revenue elevated to $17.5 million from $15.2 million year-over-year. Non-interest revenue rose to $5.2 million, in comparison with $4.1 million in Q2 2024, supported by mortgage gross sales, greater fiduciary revenue, and repair charges. Whole property have been $2.31 billion, down 2.7% from $2.37 billion on the finish of Q2 2024.

Asset high quality remained robust, with nonperforming property accounting for 0.21% of whole property, up from 0.13% a yr in the past.

LCNB plans to proceed strategic initiatives in 2025 aimed toward enhancing the stability sheet, bettering liquidity, and increasing profitability whereas sustaining glorious asset high quality.

Click on right here to obtain our most up-to-date Certain Evaluation report on LCNB (preview of web page 1 of three proven beneath):

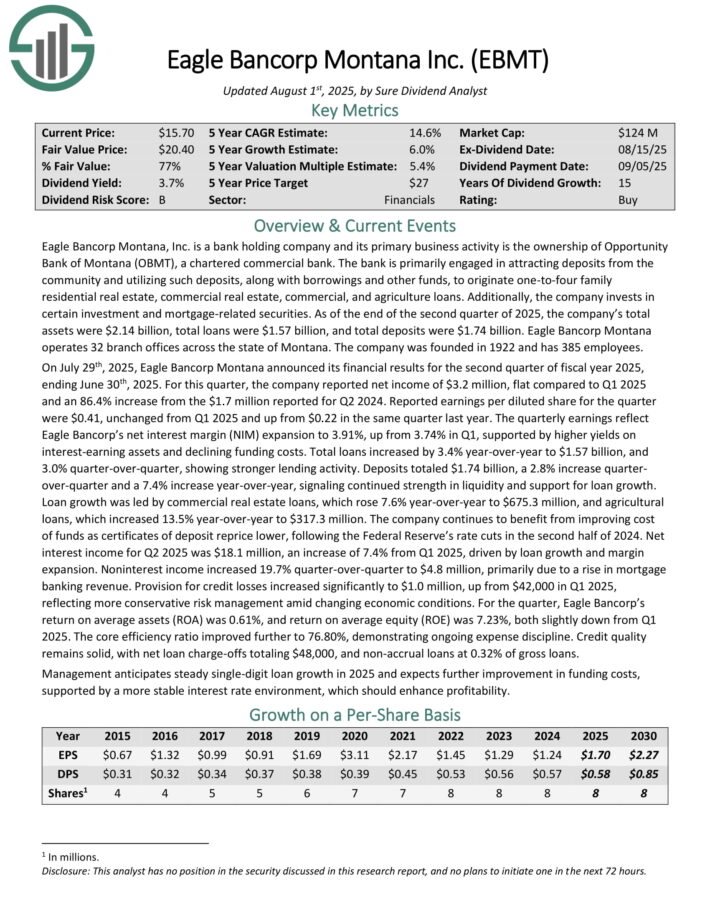

Micro Cap Inventory #9: Eagle Bancorp Montana (EBMT)

5-year anticipated annual returns: 12.2%

Eagle Bancorp Montana, Inc. is a financial institution holding firm and its main enterprise exercise is the possession of Alternative Financial institution of Montana (OBMT), a chartered business financial institution.

As of the top of the second quarter of 2025, the corporate’s whole property have been $2.14 billion, whole loans have been $1.57 billion, and whole deposits have been $1.74 billion. Eagle Bancorp Montana operates 32 department places of work throughout the state of Montana. The corporate was based in 1922 and has 385 staff.

On July twenty ninth, 2025, Eagle Bancorp Montana introduced its monetary outcomes for the second quarter of fiscal yr 2025, ending June thirtieth, 2025. For this quarter, the corporate reported internet revenue of $3.2 million, flat in comparison with Q1 2025and an 86.4% improve from the $1.7 million reported for Q2 2024.

The quarterly earnings replicate Eagle Bancorp’s internet curiosity margin (NIM) enlargement to three.91%, up from 3.74% in Q1, supported by greater yields on interest-earning property and declining funding prices. Whole loans elevated by 3.4% year-over-year to $1.57 billion, and three.0% quarter-over-quarter, exhibiting stronger lending exercise.

Deposits totaled $1.74 billion, a 2.8% improve quarter-over-quarter and a 7.4% improve year-over-year, signaling continued power in liquidity and help for mortgage development. Mortgage development was led by business actual property loans, which rose 7.6% year-over-year to $675.3 million, and agricultural loans, which elevated 13.5% year-over-year to $317.3 million.

Provision for credit score losses elevated considerably to $1.0 million, up from $42,000 in Q1 2025, reflecting extra conservative danger administration amid altering financial circumstances. For the quarter, Eagle Bancorp’s return on common property (ROA) was 0.61%, and return on common fairness (ROE) was 7.23%, each barely down from Q1 2025.

Administration anticipates regular single-digit mortgage development in 2025 and expects additional enchancment in funding prices, supported by a extra secure rate of interest setting, which ought to improve profitability.

Click on right here to obtain our most up-to-date Certain Evaluation report on EBMT (preview of web page 1 of three proven beneath):

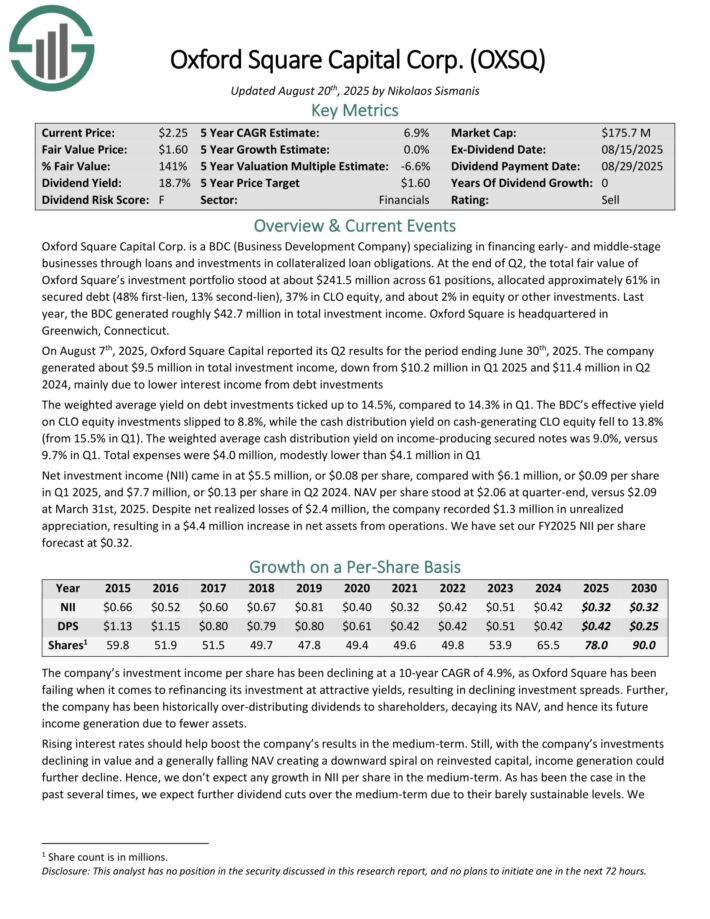

Micro Cap Inventory #8: Oxford Sq. Capital (OXSQ)

5-year anticipated annual returns: 13.0%

Oxford Sq. Capital Corp. is a BDC (Enterprise Improvement Firm) specializing in financing early- and middle-stage companies by means of loans and investments in collateralized mortgage obligations.

On the finish of final quarter, the entire honest worth of Oxford Sq.’s funding portfolio stood at about $243.2 million throughout 61 positions, allotted roughly 61% in secured debt (48% first-lien, 13% second-lien), 38% in CLO fairness, and about 1% in fairness or different investments. Final yr, the BDC generated roughly $42.7 million in whole funding revenue.

On August seventh, 2025, Oxford Sq. Capital reported its Q2 outcomes for the interval ending June thirtieth, 2025. The corporate generated about $9.5 million in whole funding revenue, down from $10.2 million in Q1 2025 and $11.4 million in Q2 2024, primarily as a result of decrease curiosity revenue from debt investments.

The weighted common yield on debt investments ticked as much as 14.5%, in comparison with 14.3% in Q1. The BDC’s efficient yield on CLO fairness investments slipped to eight.8%, whereas the money distribution yield on cash-generating CLO fairness fell to 13.8% (from 15.5% in Q1).

The weighted common money distribution yield on income-producing secured notes was 9.0%, versus 9.7% in Q1. Whole bills have been $4.0 million, modestly decrease than $4.1 million in Q1.

Internet funding revenue (NII) got here in at $5.5 million, or $0.08 per share, in contrast with $6.1 million, or $0.09 per share in Q1 2025, and $7.7 million, or $0.13 per share in Q2 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on OXSQ (preview of web page 1 of three proven beneath):

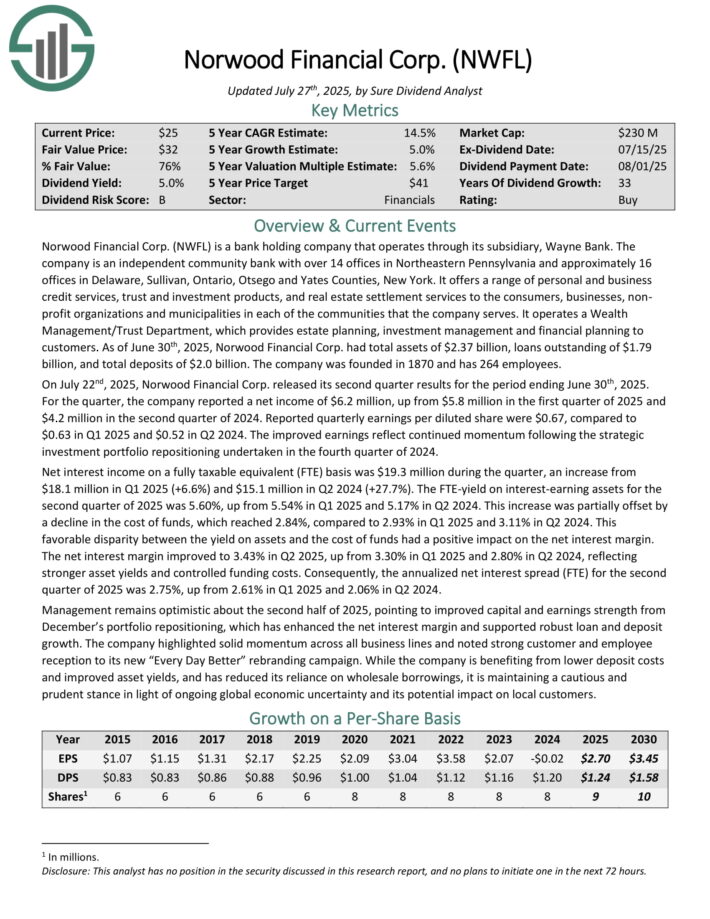

Micro Cap Inventory #7: Norwood Monetary (NWFL)

5-year anticipated annual returns: 13.2%

Norwood Monetary Corp. (NWFL) is a financial institution holding firm that operates by means of its subsidiary, Wayne Financial institution. The corporate is an impartial group financial institution with over 14 places of work in Northeastern Pennsylvania and roughly 16 places of work in Delaware, Sullivan, Ontario, Otsego and Yates Counties, New York.

It provides a variety of non-public and enterprise credit score providers, belief and funding merchandise, and actual property settlement providers to the shoppers, companies, nonprofit organizations and municipalities in every of the communities that the corporate serves. It operates a Wealth Administration/Belief Division, which offers property planning, funding administration and monetary planning to clients.

As of June thirtieth, 2025, Norwood Monetary Corp. had whole property of $2.37 billion, loans excellent of $1.79 billion, and whole deposits of $2.0 billion. The corporate was based in 1870 and has 264 staff.

On July twenty second, 2025, Norwood Monetary Corp. launched its second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, the corporate reported a internet revenue of $6.2 million, up from $5.8 million within the first quarter of 2025 and $4.2 million within the second quarter of 2024.

Reported quarterly earnings per diluted share have been $0.67, in comparison with $0.63 in Q1 2025 and $0.52 in Q2 2024. The improved earnings replicate continued momentum following the strategic funding portfolio repositioning undertaken within the fourth quarter of 2024.

Internet curiosity revenue on a totally taxable equal (FTE) foundation was $19.3 million through the quarter, a rise from $18.1 million in Q1 2025 (+6.6%) and $15.1 million in Q2 2024 (+27.7%). The FTE-yield on interest-earning property for the second quarter of 2025 was 5.60%, up from 5.54% in Q1 2025 and 5.17% in Q2 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWFL (preview of web page 1 of three proven beneath):

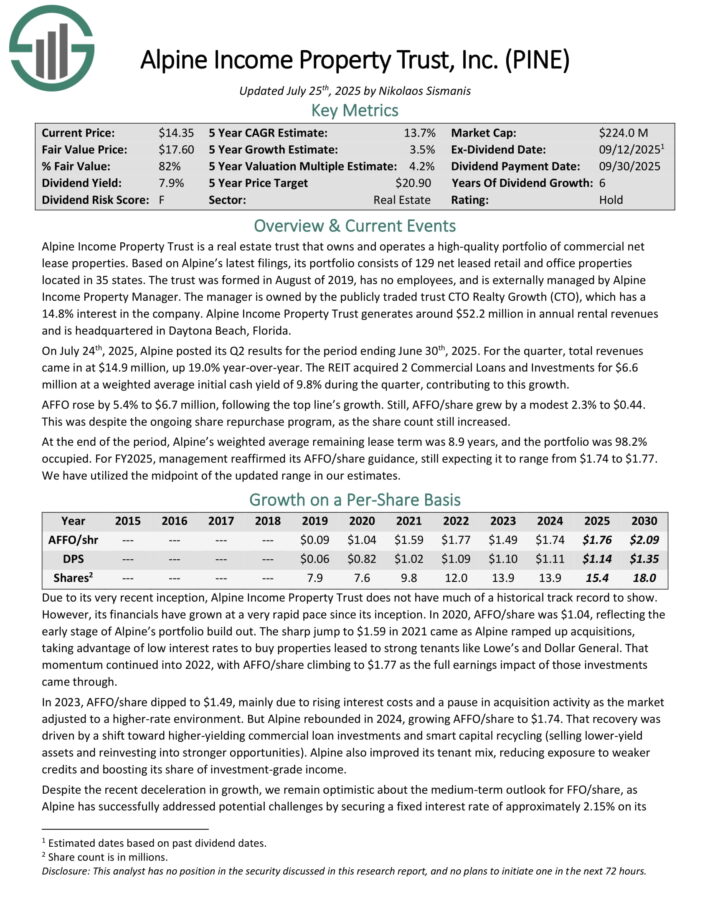

Micro Cap Inventory #6: Alpine Revenue Property Belief (PINE)

5-year anticipated annual returns: 14.2%

Alpine Revenue Property Belief is an actual property belief that owns and operates a high-quality portfolio of economic internet lease properties. Primarily based on Alpine’s newest filings, its portfolio consists of 129 internet leased retail and workplace properties situated in 35 states.

The belief was shaped in August of 2019, has no staff, and is externally managed by Alpine Revenue Property Supervisor. The supervisor is owned by the publicly traded belief CTO Realty Development (CTO), which has a 14.8% curiosity within the firm. Alpine Revenue Property Belief generates round $52.2 million in annual rental revenues and is headquartered in Daytona Seashore, Florida.

On July twenty fourth, 2025, Alpine posted its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, whole revenues got here in at $14.9 million, up 19.0% year-over-year. The REIT acquired 2 Business Loans and Investments for $6.6 million at a weighted common preliminary money yield of 9.8% through the quarter, contributing to this development.

AFFO rose by 5.4% to $6.7 million, following the highest line’s development. Nonetheless, AFFO/share grew by a modest 2.3% to $0.44. This was regardless of the continued share repurchase program, because the share depend nonetheless elevated. On the finish of the interval, Alpine’s weighted common remaining lease time period was 8.9 years, and the portfolio was 98.2% occupied.

For FY2025, administration reaffirmed its AFFO/share steerage, nonetheless anticipating it to vary from $1.74 to $1.77.

Click on right here to obtain our most up-to-date Certain Evaluation report on PINE (preview of web page 1 of three proven beneath):

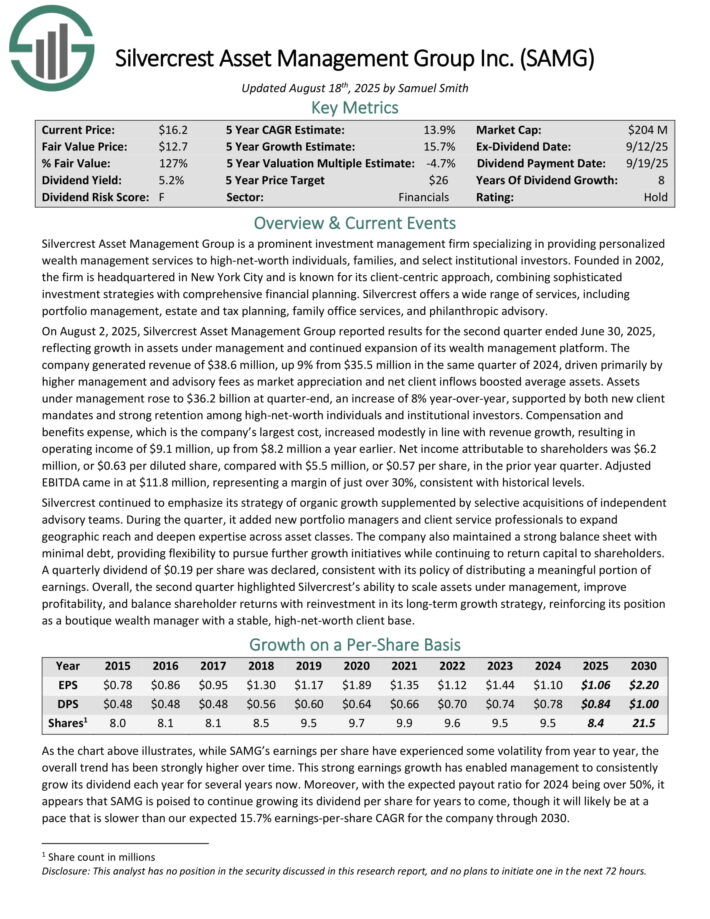

Micro Cap Inventory #5: Silvercrest Asset Administration Group (SAMG)

5-year anticipated annual returns: 14.6%

Silvercrest Asset Administration Group is a outstanding funding administration agency specializing in offering customized wealth administration providers to high-net-worth people, households, and choose institutional traders.

Based in 2002, the agency is headquartered in New York Metropolis and is thought for its client-centric strategy, combining subtle funding methods with complete monetary planning.

Silvercrest provides a variety of providers, together with portfolio administration, property and tax planning, household workplace providers, and philanthropic advisory.

On August 2, 2025, Silvercrest Asset Administration Group reported outcomes for the second quarter ended June 30, 2025, reflecting development in property underneath administration and continued enlargement of its wealth administration platform.

The corporate generated income of $38.6 million, up 9% from $35.5 million in the identical quarter of 2024, pushed primarily by greater administration and advisory charges as market appreciation and internet shopper inflows boosted common property.

Belongings underneath administration rose to $36.2 billion at quarter-end, a rise of 8% year-over-year, supported by each new shopper mandates and powerful retention amongst high-net-worth people and institutional traders.

Compensation and advantages expense, which is the corporate’s largest value, elevated modestly in step with income development, leading to working revenue of $9.1 million, up from $8.2 million a yr earlier.

Internet revenue attributable to shareholders was $6.2 million, or $0.63 per diluted share, in contrast with $5.5 million, or $0.57 per share, within the prior yr quarter. Adjusted EBITDA got here in at $11.8 million, representing a margin of simply over 30%, according to historic ranges.

Click on right here to obtain our most up-to-date Certain Evaluation report on SAMG (preview of web page 1 of three proven beneath):

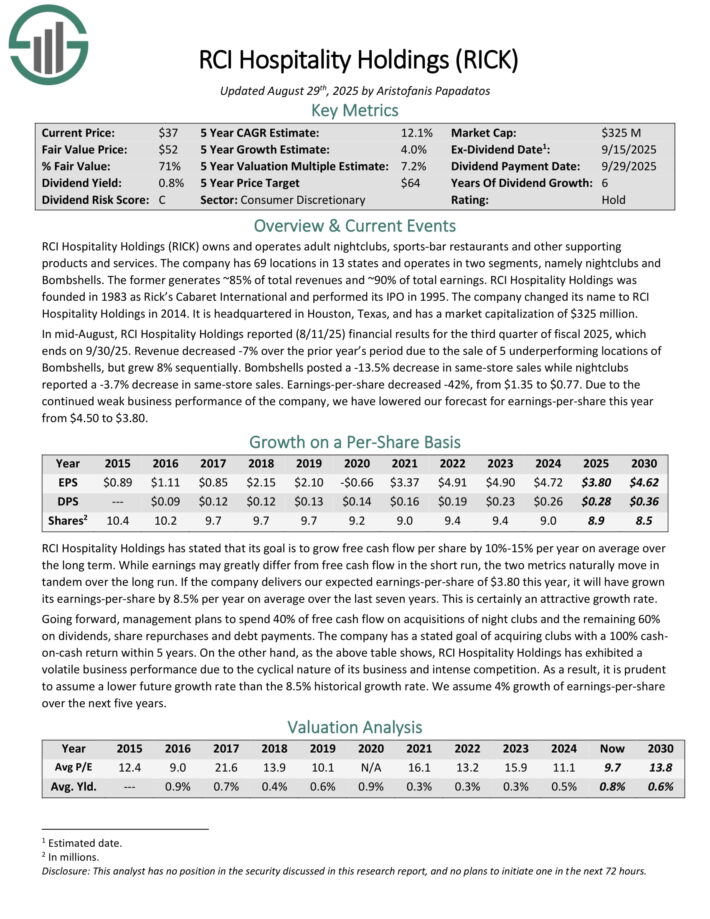

Micro Cap Inventory #3: RCI Hospitality Holdings (RICK)

5-year anticipated annual returns: 16.7%

RCI Hospitality Holdings owns and operates grownup nightclubs, sports-bar eating places and different supporting services and products.

The corporate has 69 places in 13 states and operates in two segments, particularly nightclubs and Bombshells. The previous generates ~85% of whole revenues and ~90% of whole earnings.

RCI Hospitality Holdings was based in 1983 as Rick’s Cabaret Worldwide and carried out its IPO in 1995. The corporate modified its identify to RCI Hospitality Holdings in 2014. It’s headquartered in Houston, Texas.

In mid-August, RCI Hospitality Holdings reported (8/11/25) monetary outcomes for the third quarter of fiscal 2025, which ends on 9/30/25. Income decreased -7% over the prior yr’s interval because of the sale of 5 under-performing places of Bombshells, however grew 8% sequentially.

Bombshells posted a -13.5% lower in same-store gross sales whereas nightclubs reported a -3.7% lower in same-store gross sales. Earnings-per-share decreased -42%, from $1.35 to $0.77..

Click on right here to obtain our most up-to-date Certain Evaluation report on RICK (preview of web page 1 of three proven beneath):

Micro Cap Inventory #2: Horizon Expertise Finance (HRZN)

5-year anticipated annual returns: 18.4%

Horizon Expertise Finance Corp. is a BDC that gives enterprise capital to small and medium–sized corporations within the know-how, life sciences, and healthcare–IT sectors.

The corporate has generated engaging danger–adjusted returns by means of straight originated senior secured loans and extra capital appreciation by means of warrants.

On August seventh, 2025, Horizon introduced its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, whole funding revenue fell 4.5% year-over-year to $24.5 million, primarily as a result of decrease curiosity revenue on investments from the debt funding portfolio.

Extra particularly, the corporate’s dollar-weighted annualized yield on common debt investments in Q2 of 2025 and Q2 of 2024 was 15.8% and 15.9%, respectively.

Internet funding revenue per share (IIS) fell to $0.28, down from $0.36 in comparison with Q2-2024. Internet asset worth (NAV) per share landed at $6.75, down from $9.12 year-over-year and $8.43 sequentially.

After paying its month-to-month distributions, Horizon’s undistributed spillover revenue as of the top of the quarter was $0.94 per share, indicating a substantial money cushion. Administration assured traders of the dividend’s stability by declaring three ahead month-to-month dividends at a price of $0.11.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRZN (preview of web page 1 of three proven beneath):

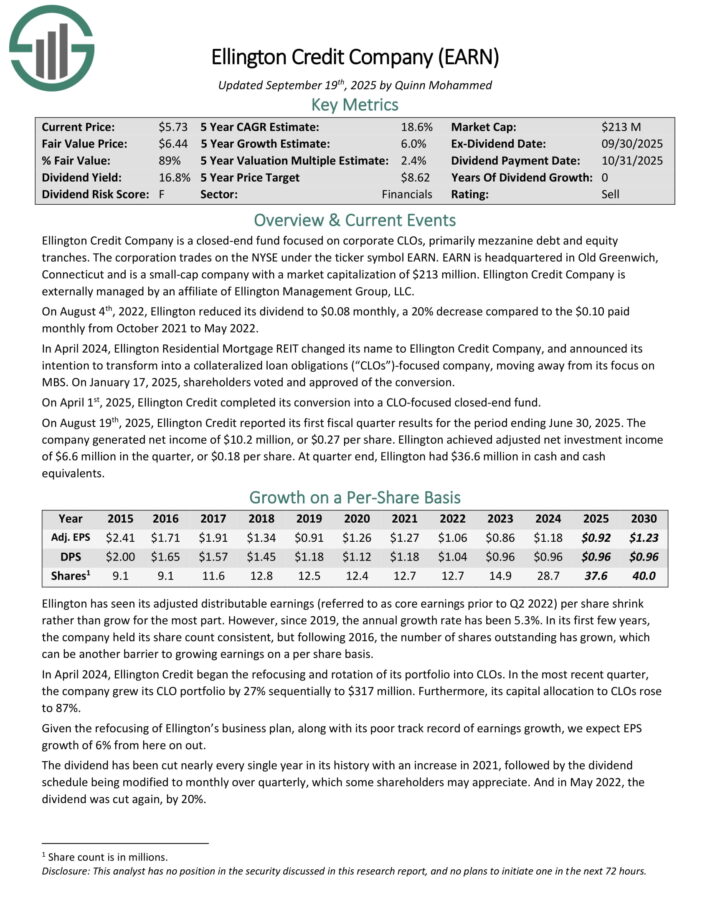

Micro Cap Inventory #1: Ellington Credit score Co. (EARN)

5-year anticipated annual returns: 18.6%

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities businesses or enterprises, whereas non-agency MBS are not assured by the federal government.

On August nineteenth, 2025, Ellington Credit score reported its first fiscal quarter outcomes for the interval ending June 30, 2025. The corporate generated internet revenue of $10.2 million, or $0.27 per share.

Ellington achieved adjusted internet funding revenue of $6.6 million within the quarter, or $0.18 per share. At quarter finish, Ellington had $36.6 million in money and money equivalents.

Click on right here to obtain our most up-to-date Certain Evaluation report on EARN (preview of web page 1 of three proven beneath):

Ultimate Ideas

Micro-cap shares are the smallest corporations at present buying and selling on the inventory market. The potential advantage of investing in micro-cap shares is the potential for greater development, and shareholder returns, over time.

After all, traders must rigorously contemplate the distinctive dangers related to investing in micro-cap shares. The ten micro-cap shares on this record all pay dividends to shareholders and have constructive anticipated returns.

In consequence, these 10 micro-cap shares might be engaging for dividend development traders.

Different Dividend Lists

The next lists comprise many extra high-quality dividend shares:

The Dividend Aristocrats Checklist is comprised of 69 shares within the S&P 500 Index with 25+ years of consecutive dividend will increase.

The Dividend Achievers Checklist is comprised of ~400 NASDAQ shares with 10+ years of consecutive dividend will increase.

The Dividend Kings Checklist is much more unique than the Dividend Aristocrats. It’s comprised of 56 shares with 50+ years of consecutive dividend will increase.

The Excessive Yield Dividend Kings Checklist is comprised of the 20 Dividend Kings with the very best present yields.

The Excessive Dividend Shares Checklist: shares that enchantment to traders within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Checklist: shares that pay dividends each month, for 12 dividend funds per yr.

The Dividend Champions Checklist: shares which have elevated their dividends for 25+ consecutive years.Notice: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have extra necessities like being in The S&P 500.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.